Two Years Waiting for the New York Times to Write About Lawyers & Loan Modifications, and they Still GET IT WRONG.

When I first read David Streitfeld’s article headline: “Homes at Risk, and No Help From Lawyers,” which ran on December 20th, in The New York Times

I thought…

Wow, well it’s about time… maybe someone’s finally gotten it.

Then I read the article and now I’m only filled with a sense of profound disappointment, resignation even. Never have I seen anything so inadequately understood by so many for so long. Never have I seen such an absolute failure on the part of my government to address the needs of so many millions Americans.

It’s inexcusable, really. Two years and 381 articles ago I started writing about issues related to loan modifications and the foreclosure crisis, two years ago Christmas Eve, as a matter of fact. What a way to celebrate such a milestone, to find out that whatever I’ve tried to do, few listened or learned a damn thing. And the pain that ongoing ignorance has caused is immeasurable. What a tragedy.

David Streitfeld’s article opens by saying:

“In California, where foreclosures are more abundant than in any other state, homeowners trying to win a loan modification have always had a tough time.

Now they face yet another obstacle: hiring a lawyer.”

The Times’ story then went on to recount the following tale:

“Sharon Bell, a retiree who lives in Laguna Niguel, southeast of Los Angeles, needs a modification to keep her home. She says she is scared of her bank and its plentiful resources, so much so that she cannot even open its certified letters inquiring where her mortgage payments may be. Yet the half-dozen lawyers she has called have refused to represent her.”

“They said they couldn’t help,” said Ms. Bell, 63. “But I’ve got to find help, because I’m dying every day.”

Then Mr. Streitfeld provides a misguided explanation for this problem, as faced by Ms. Bell, saying:

“Lawyers throughout California say they have no choice but to reject clients like Ms. Bell because of a new state law that sharply restricts how they can be paid. Under the measure, passed overwhelmingly by the State Legislature and backed by the state bar association, lawyers who work on loan modifications cannot receive any money until the work is complete. The bar association says that under the law, clients cannot put retainers in trust accounts.”

Okay, this is where Mr. Streitfeld’s article confuses the facts related to California’s “new” law, and therefore proceeds to misstate just about everything he needs to make his key point. I understand how it happened, however, as it’s an easy mistake to make, thanks to the California State Bar’s ongoing refusal to make clear what California’s “new” law prohibits and what it allows.

The “new” California law that Mr. Streitfeld references is known as Senate Bill 94 (“SB 94”) and it was passed by the state legislature in 2009, and signed into law by Governor Schwarzenegger on October 12, 2009. Sen. Ron S. Calderon, Chairman of the Senate Committee on Banking Finance & Insurance, sponsored the bill.

Let’s get this subject straightened out once and for all:

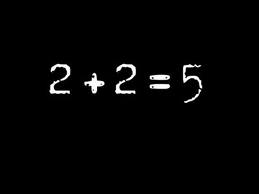

SB 94 DOES NOT REQUIRE lawyers who offer to represent homeowners seeking loan modifications to wait until their clients’ loans are modified before being paid. IT DOESN’T SAY THAT.

Allow me to explain in the most direct way possible. To begin with, California SB 94 impacts two groups: Real Estate Licensees and Attorneys.

As the new law pertains to attorneys, SB 94 created one new section of the Business & Professions Code, and two new sections of the California Civil Code, as follows:

B&P 6106.3 – NEW… This is just the enabling language that states that the State Bar can discipline lawyers for violations of the new law. It doesn’t establish or restrict anything; it is only language that enables some sort of enforcement should the law be violated by an attorney.

Civil Code 2944.6 – NEW… This section states that attorneys must provide a new NOTICE to their clients that they do not have to pay anyone to help them get their loan modified, they may attempt it on their own by contacting their servicer directly, or they may contact a HUD counselor for assistance that’s free of charge.

Civil Code 2944.7 – NEW… This is the language that contains the operative phrase, which states that an attorney cannot: Claim, demand, charge, collect, or receive any compensation until after the person has fully performed each and every service the person contracted to perform or represented that he or she would perform.

As SB 94 pertains to real estate licensees, there are two sections of the Business & Professions Code affected, one is new, the other has been amended.

B&P 10085.6 – NEW… This is a duplicate of the language that also applies to attorneys above that contains the operative phrase: as a real estate licensee, you cannot: Claim, demand, charge, collect, or receive any compensation until after the person has fully performed each and every service the person contracted to perform or represented that he or she would perform.

B&P 10026 – AMENDED… This language modifies the definition of advance fee for real estate licensees, prohibiting said licensees from breaking up the services related to a loan modification.

It is important to note that these sections are in Division 4 of the Business and Professions Code, which applies only to real estate licensees and not to attorneys. Bus. & Prof. Code Section 100116 defines “licensee” as “a person, whether broker or salesman, licensed under any of the provisions of this part.”

Do you see where the confusion is coming from? B&P 10026 has been amended to prohibit real estate licensees from breaking up the services related to a loan modification into component parts. However, there is no corresponding language that applies to attorneys, and therefore attorneys are permitted to break up the services related to a loan modification into component parts.

That means that lawyers helping homeowners obtain loan modifications, can contract to perform a specified set of services related to a loan modification, and be paid for those services once they have been completed. Nowhere in SB 94 does it say that a lawyer must obtain a loan modification for his or her client before being paid for services by that client.

Here is the text of the California Civil Code created by SB 94:

2944.7. (a) Notwithstanding any other provision of law, it shall be unlawful for any person who negotiates, attempts to negotiate, arranges, attempts to arrange, or otherwise offers to perform a mortgage loan modification or other form of mortgage loan forbearance for a fee or other compensation paid by the borrower, to do any of the following:

(1) Claim, demand, charge, collect, or receive any compensation until after the person has fully performed each and every service the person contracted to perform or represented that he or she would perform.

And here’s the language, related to charging homeowners fees for helping them obtain a loan modification, that applies to those licensed by the state’s Department of Real Estate:

SEC. 5. Section 10085.6 is added to the Business and Professions Code, to read:

10085.6. (a) Notwithstanding any other provision of law, it shall be unlawful for any licensee who negotiates, attempts to negotiate, arranges, attempts to arrange, or otherwise offers to perform a mortgage loan modification or other form of mortgage loan forbearance for a fee or other compensation paid by the borrower, to do any of the following:

(1) Claim, demand, charge, collect, or receive any compensation until after the licensee has fully performed each and every service the licensee contracted to perform or represented that he, she, or it would perform.

And here is the language amending B&P Code 10026:

10026. The term “advance fee” as used in this part is a fee, regardless of the form, claimed, demanded, charged, received, or collected by a licensee from a principal before fully completing each and every service the licensee contracted to perform, or represented would be performed. Neither an advance fee nor the services to be performed shall be separated or divided into components for the purpose of avoiding the application of this section.

Again, this means that a person licensed by the state’s Department of Real Estate who enters into an agreement to assist a homeowner in obtaining a loan modification cannot be paid until the homeowner receives a modification, because the services related to a loan modification cannot be divided into component parts for the purposes of billing for those services.

But an attorney, on the other hand, can contract for some limited set of services related to a loan modification, complete those services, be paid for those services, and then move on to other services as specified by separate contract.

Here’s a link to the final text of California’s SB 94, signed into law by Governor Schwarzenegger on October 12, 2009.

SB 94 vs. AB 764

Another way you can tell that SB 94 doesn’t require lawyers to wait until they obtain a loan modification for their client before being paid for any services, is by looking at the other bill that was passed by the California State Legislature in 2009, at the same time SB 94 was passed, and subsequently signed into law by the governor.

The other bill was AB 764, and like SB 94, it was also the product of a legislative committee on banking and finance, so no surprises there.

Assembly Bill 764, which was proposed by Assembly Committee on Banking and Finance Chair, Pedro Nava (D-Santa Barbara), did state that neither attorneys nor real estate licensees could be paid until a loan modification has been successfully obtained from the homeowner’s lender or servicer.

Senator Ron S. Calderon (D-Montebello), who chairs the Senate Banking Committee and whose committee was responsible for the much more rational SB 94, published an article in the Sacramento Bee in the early fall of 2009, in which he explained why he didn’t choose to take the approach contained in AB 764. In that article he said:

“I considered the approach in AB 764 when drafting SB 94, but ultimately rejected it for three reasons.

First, preventing fee-for-service providers from charging their clients, unless they obtain a modification, will almost certainly increase the fees that fee-for-service providers charge their clients. If fee-for-service providers can only charge certain clients, they will need to increase the fees they charge those clients, to make up for their inability to charge other clients.

Second, the approach in AB 764 is likely to cause fee-for-service providers to cherry-pick their clients. If a provider knows he or she can only get paid if a modification is offered to a borrower, that provider is unlikely to take on the difficult cases, leaving borrowers most in need of help with fewer options for assistance.

Third, AB 764 is likely to force many fee-for-service providers out of business, which is likely to reduce the options for troubled borrowers even further.”

Now, logic should at this point dictate:

There were two bills, and one of them, AB 764, did in fact prohibit both lawyers and real estate licensees from being paid prior to a loan modification being obtained.

The author of the other one, SB 94, would not state publicly that he chose not to go with the approach in AB 764, for the reasons stated, if his bill were accomplishing the same objective in the same way.

Is that making any sense for anyone? Lord, I do hope so, but if not… perhaps it would be helpful to read the governor’s letter to the California State Assembly explaining why he chose to veto AB 764 and sign SB 94 into law. The governor’s message to the State Assembly follows:

To the Members of the California State Assembly:

I am returning Assembly Bill 764 without my signature.

Although I support the prohibition of individuals charging advance fees for mortgage loan modifications, I do not agree with the provision of this bill that will only allow feesӬto be collected if a modification is successful.

This could adversely affect legitimateӬbusinesses that provide loan modification services. As such, I am signing SB 94 thatӬaccomplishes this prohibition against advance fees without unnecessarily harmingӬlegitimate companies.

For these reasons, I am unable to sign this bill.

Sincerely,

Arnold Schwarzenegger

Can you hear me now? Is that doing it for you? The facts about California attorneys who offer to assist homeowners with loan modifications as presented in the New York Times story are just plain WRONG.

SB 94 does not prohibit an attorney licensed to practice law in California from being paid in conjunction with a loan modification, until a loan modification has been obtained. It only says that attorneys must complete the services they’ve contracted to complete before being paid for those services.

Under the new law, it’s only real estate licensees that are not permitted to charge a homeowner a fee until a loan modification is obtained, because the new law does not allow real estate licensees to divide said services into component parts as related to a loan modification.

David Cameron Carr, a State Bar Defense and Ethics attorney practicing in San Diego, California agrees wholeheartedly with the view of SB 94 as I’ve presented it here, as do numerous other Bar Defense lawyers throughout the state. As to the legislative intent of SB 94, and the validity of lawyers unbundling services, David offers the following:

“The intent of the Legislature and the Governor was not to put legitimate firms out of business, rather it was to ensure that homeowners are only changed for work that has legitimately been done in service of the clients’ goal to modify their mortgage.

Attorneys cannot guarantee the outcome of legal representation and the banks have not made it easy for individuals seeking to modify their loan obligations, whether they are represented by attorneys or not. Staking all of the attorney’s fees on the successful loan modifications will lead to no attorneys willing to even make the effort. This is an access to justice issue clearly recognized by the Governor when he vetoed AB 764.

Allowing consumers to pay for legal services in discrete “˜unbundled’ increments serves the interests of clients and attorneys. Chief Justice Ronald George recently co authored an op-ed article in the New York Times praising unbundled practice as allowing “˜lawyers – especially sole practitioners – to service people who might otherwise have never sought legal assistance.'”

And that, as they say, is all I have your honor. The defense rests.

The New York Times article, however, doesn’t. It goes on to say:

Two years ago, the state bar association had seven complaints of misconduct in loan modifications. By March 2009, there were more than 100 complaints, and a task force was formed to deal with the problem. Soon, there were thousands of complaints.

It was a public relations disaster. The president of the bar association (Howard B. Miller) wrote in a column last year that “hundreds, and perhaps thousands, of California lawyers” were victimizing people “at the most vulnerable point in their lives.”

Now, I couldn’t even count all of the articles I’ve written about these sort of statements at the time (here’s one: Did Attorneys “Turn Bad” in 2009? What… Was there something in the water?), but the bottom line is, that for all the “witch hunting” that went on back then, with lawyers playing the role of the “witches,” the California State Bar, in a state with 206,000 licensed, practicing attorneys, has posted the following results as of September of 2010, according to the California Bar Journal, which is the “Official Publication of the State Bar of California.”

“The bar’s Office of Chief Trial Counsel has obtained the resignations of 12 attorneys involved in loan modification misconduct since creation of the task force in April 2009. Six loan modification trials are pending…”

So, this April it will have been two years since the California State Bar established its Task Force to root out the “hundreds, or perhaps thousands of California lawyers” who were said to be victimizing people “at the most vulnerable point in their lives.” And yet to-date, the California State Bar has obtained the resignations of 12 attorneys involved in loan modification misconduct. Oh yeah, and there are six more trials pending.

I’m certainly not saying there weren’t more illegal operators, scammers, and/or lawyers operating outside the rules, and in fact the California Bar Journal also states that there are 1800 active investigations underway, but with a dozen resignations and six trials pending… after almost two years… the idea that there were ever thousands of California attorneys victimizing people “at the most vulnerable point in their lives,” well… it was just preposterous then and it’s even more so today.

Today, it should be clear that the media and the public believed that sort of obvious fear-based hyperbole back then because back in mid-2009, pretty much everyone believed two things that we now know were far from true:

- That President Obama’s plan to save homes from foreclosure would work as advertised, or at least close to as advertised. The president had told the nation that “loan modifications were free,” and that you could “call a HUD counselor,” or “contact your bank directly.” And with the government and the banks reinforcing the message, why would anyone think you’d need a lawyer?

- That the banks would deal with homeowners applying for a loan modification in a reasonable way, and follow the rules of the president’s plan to some reasonable degree.

With these two thoughts firmly implanted in the minds of the media and the masses, and with no personal experience to tell them otherwise, it made sense that when someone had paid a company to help them get their loan modified, and their loan did not get modified, it had to be the company’s or the lawyer’s fault… it had to be that the lawyer or company was scamming the homeowner, taking their money and delivering nothing in return.

By the end of 2009, however, it became clear that the president’s program was not working as advertised, and that the banks were not following the program’s rules, or oftentimes any rules, for that matter, and as a result, more and more people started to think that perhaps one should hire a lawyer when applying for a loan modification.

And certainly today, with consumer attorney superstars like Max Gardner and others, making news of banks using robo-signers to create fraudulent paperwork leading to improper foreclosures, along with stories of banks misleading homeowners and even attempting to foreclose on homes they don’t own, it should be abundantly clear that a homeowner should at least consider hiring an attorney when at risk of foreclosure.

But… it’s about to be 2011… and frankly there’s no excuse for this sort of misconception to still be going around… and there’s certainly no reason for any lawyers in California to be afraid to represent a homeowner who is seeking a loan modification based on the requirements of SB 94.

Of course, none of this is to say that hiring a lawyer to represent you when seeking a loan modification offers any sort of guarantee that you’ll get your loan modified, but then you never hire a lawyer when the outcome is certain. You only hire a lawyer when the outcome is uncertain. If the outcome were certain, why would you pay an attorney?

In this case, homeowners that choose to hire a lawyer to help them get their loans modified do so because they believe that their attorney has more experience in the area and will therefore have a better chance at getting the loan modified, and I think this is unquestionably true. In my somewhat vast experience talking with homeowners at risk of foreclosure, and with attorneys that specialize in helping homeowners obtain loan modifications, I have absolutely no question in my mind that many homeowners need professional help getting their loans modified.

For one thing, homeowners at risk of foreclosure are scared and don’t relish the idea of talking with their servicer, who is often rude and unaccommodating. For another, many feel ashamed that they are at risk of losing their homes, and that makes dealing with a mortgage servicer or bank that much more difficult. And lastly, most homeowners don’t know their rights as related to foreclosure, or the rules and guidelines under the HAMP program, and they tend to panic or act irrationally as a result.

From the story in the New York Times:

Lenders were supportive of the bill, Senator Calderon said.

The law is working well, Senator Calderon said. “You do not need a lawyer,” he said.

Look, obviously Senator Calderon has never had a particularly thorough understanding of what’s going on in real life as related to loan modifications and the foreclosure crisis. But we can hardly blame him for that… he’s the California Senate’s Banking and Finance Committee Chair, so what would you expect?

So, allow me to be blunt, so as to avoid any confusion as to the facts of the matter:

The law is not working well… in fact it’s not working at all. It has accomplished almost nothing in regards to protecting consumers from scammers. But then… it never had a chance of working well, or at all, so I suppose in that sense, it is living up to its potential.

And as to Senator Calderon’s claim that you do not need a lawyer to obtain a loan modification, he’s quite right. You don’t NEED a lawyer… it’s not a requirement. But for many people, it sure as heck can help… a lot. Having interviewed over a thousand homeowners and hundreds of attorneys that represent homeowners at risk of foreclosure, I can tell you this… I wouldn’t try it on my own, but again… that’s me. Everyone has to make their own decision as to whether they want or need an attorney. My father prepares his own tax returns, so go figure.

If the State of California wants to eliminate the scammers who prey on distressed homeowners with promises of loan modifications, the answer is not to make it illegal to charge a fee. That only eliminates the legal operators… the scammers don’t care about laws that prohibit them from being paid up front… that’s why they’re called scammers… because they break the laws.

And as I predicted at the time, since SB 94 took effect last year, the scammers shifted into offering products and services not covered by SB 94… oooh, that was a hard one to see coming, wasn’t it? I’m a genius, I realize. They started selling “forensic loan audits,” that often cost thousands of dollars but were about as valuable as the paper they were printed upon.

And then, more recently, business entities calling themselves “Doc Prep” companies arrived on the scene, offering to prepare the documents needed to apply for a loan modification on behalf of a homeowner for several thousand dollars up front.

The point has been rendered moot by the FTC’s recent announcement of its new MARS rule, which is a federal rule that fully takes effect on Jan 30, 2011. MARS governs how “Mortgage Assistance Relief Services” providers may operate and be paid for their services, but for the record, I contacted Tom Pool at the California Department of Real Estate, to find out if these doc Prep companies were operating in violation of SB 94, and his view was they that they are in fact operating in violation of the new law.

There are also companies out there who lure homeowners with all sorts of programs that promise relief from foreclosure. And some are now soliciting homeowners to be participants in various lawsuits for a fee. My only advice is to be careful out there… because SB 94 isn’t going to protect you from smooth talking salespeople looking to make a commission by selling you a pig in a poke. In case it’s helpful, here’s a link to my recent article: How to Tell Legitimate Loan Modification Firm from an Illegal Operation or Scam… The FTC’s New Bright Line MARS Rule.

The point is that if the State of California wants to get rid of the scammers, the answer is to let homeowners know where they can go to get legitimate assistance, and “call your bank directly,” or “contact a HUD counselor,” is neither helpful, nor is it credible.

The State Bar has hidden from SB 94 for over a year now, refusing to come out publicly with any sort of clarification on how they interpret the new law. All they’ve said is that attorneys cannot accept up front funds from a homeowner seeking a loan modification into their attorney trust account… which is absurd, especially when you consider that the new FTC MARS rule REQUIRES lawyers offering to help homeowners obtain loan modifications to put advance fee retainers into their attorney trust accounts. (Although the FTC’s MARS rule is subject to state law, so lawyers representing homeowners seeking loan modifications will continue to practice as they have been under SB 94.)

I’m sorry to have to say this, but by hiding from the new law, the State Bar has made it more difficult for homeowners to hire an attorney, as shown in the New York Times story, and as a result, made it more likely for homeowners to end up getting scammed.

If you want to get rid of scammers, make legitimate loan modification legal assistance available at every Starbucks… no more scammers. It’s not different than getting rid of bootleggers, which you do by putting a liquor store on every corner in town… no more bootlegger. You certainly aren’t going to get rid of scammers by making it harder to find a legitimate attorney, because when people are losing their home, and they can’t find help… they panic. And panic is the fastest path to getting scammed there is.

The truth is, there are scammers around us every single day of our lives. But we don’t get scammed every day, because we’re not in a panic. The first day we are, is the day we’ll find ourselves having been parted with our hard-earned money by some con artist.

So, when Mr. Streitfeld’s New York Times article opens by saying:

“In California, where foreclosures are more abundant than in any other state, homeowners trying to win a loan modification have always had a tough time.

I can’t argue with that, assuming that he’s referring to the banks’ and mortgage servicers’ behavior as related to loan modifications.

I assume that he’s referring to the banks and mortgage servicers disregarding every rule or guideline set forth in the president’s Home Affordable Modification Program, HAMP, along with most of the state laws related to the foreclosure process, and are now being investigated by all 50 state attorneys general for loan modification fraud.

Is that what you meant by “had a tough time,” Mr. Streitfeld?

I could try to list all of the abuses committed by the bankers and mortgage servicers, but I’m not sure one person could do it comprehensively in less than a year. You’d need to put an entire team on it, and they’d likely still miss a few.

At this point, the four largest players in the mortgage market, GMAC, JPMorgan Chase, Wells Fargo Bank, and of course, Bank of America all stand accused of bringing fraud on the courts by submitting their robo-signed affidavits, their forged signatures, and numerous others violations of the laws governing the transfer of property rights in this country.

Most recently, in New Jersey where a judge is presiding over the KEMP v Countrywide suit, Bank of America, in an effort to establish that they should be allowed to foreclose on the Kemp’s home, has tried three times to do so with fraudulent documents, the last time so flagrantly, that BofA’s lawyer had to ask the court to allow the bank to withdraw the evidence they’d submitted.

In point of fact, the banks and servicers are being sued from parties on all sides of the situation… by homeowners, both individually and as members of various class action lawsuits, by investors who claim they were defrauded by a failure to comply with underwriting requirements of the Pooling and Servicing Agreements that govern their investments in the mortgage-backed securities that allegedly hold the mortgages in question. And by various state governments, including Arizona and Nevada, who have each filed suits alleging loan modification fraud against Bank of America as of a few weeks ago.

And on several well-documented occasions, the banks have even foreclosed or attempted to anyway, on homes on which they never even held a mortgage.

So, yes… I think it’s safe to say that homeowners in California and elsewhere have had a “tough time,” when it comes to obtaining loan modifications. And I would think that this sort of “tough time” would lead just about anyone over the age of nine to conclude that homeowners should at least consult with an attorney before attempting to get their loans modified.

In fact, there are only two groups opposed to this idea: the bankers and the politicians clearly in the pocket of the banks. Anyone else opposed to the idea is just a derivative of one of these two groups, and neither is looking out for the best interests of the homeowners when forming their views.

Look, I understand why bankers wouldn’t want homeowners to hire attorneys when at risk of foreclosure; it would make things much, much easier for bankers if homeowners showed up alone and unarmed, after all.

Without an attorney, it’s Bank of America against Mr. & Mrs. Jones, who are emotional, unknowledgeable and afraid… and BofA can mow over them with their foreclosure mill lawyers without any resistance to speak of in their way. Without lawyers, no one would have ever discovered the fraudulent documents being used by the bankers to foreclose on properties, for example, so I absolutely understand why the bankers would be attempting to make it difficult for a homeowner to hire a lawyer to help them prevent foreclosure.

I also find such an impetus despicable and wholly devoid of moral character. If the banks in this country are going to oppose basic fairness, then they should be nationalized and turned into the equivalent of public utilities… and in my opinion they quite likely will one day if they continue on their current path.

Mandelman out.

~~~~~~

Other articles I’ve written on the topic:

Are Lawyers Turning to Crime in Tough Times?

ONCE AND FOR ALL, THE ANSWER IS YES. Water is wet, the sky is blue, and you need a lawyer… Period.

How banks view loan modifications.

HO, HO, Homeless… A Sobering View of the Crisis We Still Don’t Want to Understand.

A TIME FOR GOOD JUDGEMENT: The jury is in AND we need judges to modify the way banks behave.

~~~

Hey… why not take a minute and SUBSCRIBE to Mandelman Matters so you’ll get it delivered to your email daily? Don’t worry, you don’t have to read it, if you don’t want to. But you’ll feel better when you do!