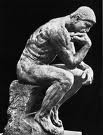

BRINGING UP THE REAR FTC Chairman Jon Leibowitz

I’m really starting to struggle with this “loan modification fraud” stuff. I’ve never been quite comfortable with the whole thing… ever since Treasury Secretary Geithner and Attorney General Holder went on national television last April 6th, and at best misled the American people… and me personally… on the subject of loan modification fraud.

I didn’t even need to go back and look up that date, April 6, 2009, and I’m sure it’s correct. I suppose I’ll remember it forever… a day that shall live in infamy, in my mind anyway.

Attorney General Eric Holder and Treasury Secretary Tim Geithner that Monday morning addressed the nation about the government’s response to the fraudulent loan modification scams. They claimed scams were sweeping the nation. They made it sound like the problem was an epidemic; like there was a fraudulent loan modification company around every corner. They knew then that the key number they were quoting had nothing to do with loan modification scams. They also had no idea whether those being accused were in fact even scamming homeowners.

Here it is from the Associated Press, but I’m sure you can look on YouTube, if you’d like to see it come from the horse’s ass… mouth… I meant mouth:

Government cracking down on mortgage scams, by The Associated Press, April 6, 2009

… The Federal Trade Commission has sent warning letters to 71 companies it says were running suspicious advertisements and has filed five new civil cases to halt illegal loan modification scams. Attorney General Eric Holder says the FBI is investigating about 2,100 mortgage fraud cases.

Did you catch the lie? Chances are you did not. I didn’t either, at the time. Here’s the lie:

“Attorney General Eric Holder says the FBI is investigating about 2,100 mortgage fraud cases.”

Was the FBI investigating about 2,100 mortgage fraud cases? You bet they were. It said so right on the FBI Website. However, those 2,100 mortgage fraud cases were filed between 2003 and 2009. The FBI’s Website also provides a definition of “mortgage fraud” that has just about nothing to do with the loan modification scams Holder and Geithner were talking about on April 6, 2009, when they gave out the number as if it was relevant.

They needed a big number, something larger than 71 or 5, and they found one. So they used it. And that’s, at best, deceptive crap. My mother, I’m almost positive, would call it lying.

Today, congress has given the FTC the responsibility to develop a new federal rule under which organizations offering to help homeowners obtain loan modifications, including law firms and individual attorneys, will have to operate.

Now, let’s establish a couple of facts:

1. On February 18, 2009, President Obama introduced his Making Home Affordable foreclosure rescue plan, and said that getting a loan modification was free and easy… all you had to do was call the handy dandy, toll-free government phone number… or just call your bank directly.

2. People need help to negotiate a loan modification with a bank or mortgage servicer. Even President Obama thinks so and that’s why he’s spent tens of millions funding various nonprofit agencies to provide such help, however ineffectively they’ve been. To-date there have been hundreds, if not thousands of stories of servicers abusing homeowners who have tried going it on their own. I’ve personally been contacted by thousands who said they gave up and simply needed help.

3. The debate about HAMP, or Home Affordable Modification Program is over. It’s a prodigious failure… the contrast between its promise and what it has delivered is staggering. Although the latest reports on HAMP are encouraging, to-date its claim to fame is that it out-performed Dubya’s Hope-4-Homeowners plan, which after six months had only modified one solitary mortgage. (Okay, that may be unfair, but you know what I’m saying…)

As a corollary, trial modifications are the biggest loan modification scam the country has ever seen. The bank tells you to make three payments of some amount that won’t reduce your indebtedness, but will be reported to the credit bureaus as delinquent payments, so that after you’ve made all three on time and as agreed, they can sell your home without notice.

So, what does this have to do with Mr. Jon Leibowitz, Chairman of the FTC? Well, Mr. Leibowitz is either oblivious to the facts, is a politician looking for his next appointed post… or is in the pocket of the banking lobby… I have no idea which, but it’s one of the three.

With the whole save-my-house-through-a-loan-modification thing going swimmingly, the FTC has decided the best way to protect homeowners from “scammers” who promise to help homeowners obtain a loan modification is to eliminate the private sector from the field… including attorneys, by making it impossible for them to be paid.

Goldman Sachs forecasts 14 million foreclosures in the next three years. To put that kind of a number into perspective, if there were 14 million foreclosures, and each of those people needed say 10 hours of hope-and-change-type-counseling, that would be 140 million hours of said counseling, which, assuming a 24-hour work day, 365 days a year, translates into just a scosh over 383,561 years… for one person, of course, so that’s a silly comparison.

To be more realistic, let’s say you had say… 10,000 people… why then it would only take a smidgeon over 38 years… which should provide everyone with a lot more confidence that the president’s plan may still prove itself effective without help from the private sector.

Are you feeling me here? The FTC’s proposed new rule would make it so a private sector lawyer could help a homeowner obtain a loan modification, but only be paid after the homeowner has received a loan modification. That would mean that a lawyer would have to work for months and months without being paid, or without any assurance of ever being paid. And that’s simply something that isn’t going to happen… ever. No responsible lawyer is going to represent a client under such circumstances, nor should he or she ever do so.

At best a homeowner is being faced with uncertain outcome and complexity that they should not have to handle on their own. For example, on one end there’s the federal bankruptcy code. On the other there’s civil litigation against the bank. In the middle, there are various government loan modification programs, and often additional internal bank programs. There are also short sales, Deed in Lieus, Cash for Keys deals, property tax issues, and occurrences that can make one subject to a deficiency judgment.

If nothing else, a lawyer need not be paid for obtaining a loan modification, but for all of the work along the way. Why would a lawyer agree now to have a homeowner dump nine or so months worth of work on them, and then not be permitted to send a bill for what could easily be a year? Of course, there WON’T BE A SINGLE LAWYER in the country that will do it. Not one lawyer will offer to handle the work related to a loan modification under those terms. So, this rule if adopted, will effectively take away a person’s right to an attorney when he or she is losing their home.

Perfect… the housing markets are in free fall… foreclosures are ravaging our citizenry… the government’s failed miserably to-date at trying to contain the damage… and the FTC is going to adopt a rule that makes it impossible for homeowners to hire a lawyer to help them avoid foreclosure. Perfect, Mr. Leibowitz… just perfect.

And let’s not forget, when one receives a trial or permanent modification under HAMP, or another program, they are asked to sign a legally binding contract. One that I saw was 26 pages long, if memory services… and without a doubt… written by lawyers. So, a homeowner should not consult an attorney prior to signing these documents either. Absurd.

Leibowitz continues to yammer on about how he’s going to protect American homeowners from unscrupulous scammers, but it’s too late to fall back on the vast populations living in the valley of the scammed. I’m not saying it’s been Mayberry RFD out there, but many of us were afraid to leave the house for fear we might meet a scammer. This is clearly not the case and besides, how many of those that “scammers” turned out to be people trying to get the banks to modify loans only to find out that the President can’t even do that with any regularity or predictability? I’m not the only one watching this three-ring circus remember, this stuff has finally made the news on both sides of the ideological divide.

Leibowitz, what’s the deal? If you want to get rid of the loan modification scammers, you certainly don’t reduce the number of legitimate options available to help, you let people know where they can get help… beyond calling their bank or standing in line at HUD. Those options have long since proven to be less than adequate for hundreds of thousands.

We need an FTC rule, I would agree, but we need one that helps and protects America’s homeowners in meaningful ways and certainly not one that does anything less.

We’ve already seen how effective your “fire, ready, aim” strategies have been, Jon. This time, try something new… think.