Homeowner Alert: Scammer Masquerades as Bank, Offers Fake Loan Mods

As if REAL loan modifications weren’t often illusory enough, now there are scammers masquerading as banks, offering FAKE LOAN MODIFICATIONS… and if that weren’t bad enough, the fake mods require homeowners to pay thousands of dollars for nothing.

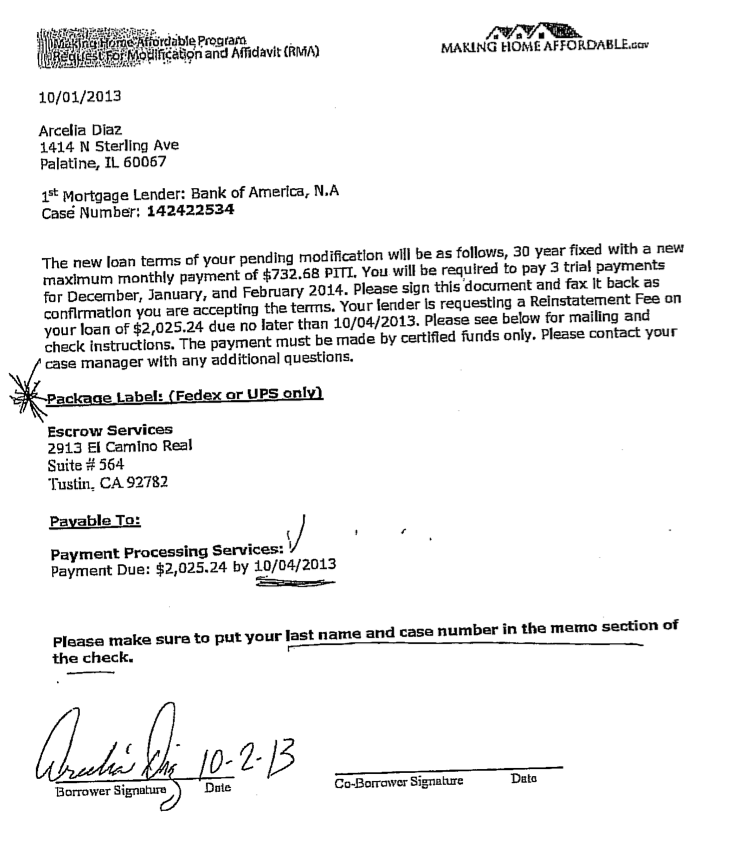

This past week, Illinois consumer attorney Rick Rogers reported that a homeowner in the Chicago area, a school teacher who had been trying for a couple years to get her loan modified had not been approved… and her home was going into foreclosure. She kept trying though until one day this past fall she received a letter that appeared to say that Bank of America was now approving her loan modification. Here’s what the letter said…

“˜The new loan terms of your pending modification will be as follows, 30 year fixed with a new maximum monthly payment of $732.68… You will be required to pay 3 trial payments for December, January and February, 2014. Your lender is requesting a Reinstatement Fee on your loan of $2,025.24, due no later than 10/04/13. Please see below for mailing and check instructions. The payment must be made by certified funds only. Please contact your case manager with any additional questions.’

As you might imagine, she was absolutely elated at the news.

She immediately called the number in the letter and spoke to her case manager who told her that she’d need to send a Cashier’s Check for $2,025.77… and that she’d better hurry because if the check was late she might lose the modification. So, the very next day she went to her bank and sent the check for certified funds by Federal Express… made out to Bank of America Payment Processing Services.

After everything she had been through, her struggle was finally over… and she would not lose her home after all.

Three months later, however, she received a letter from Bank of America saying that her home had been sold at a foreclosure auction on October 14, 2013, just 10 days after she had sent the check for $2,025.77 to Bank of America. She would be evicted in a month if she didn’t move out.

How could this possibly be? There had to be a mistake, right? Her loan had been modified. She had called the bank to confirm everything… talked to her case manager…

Or at least that’s what she thought had happened.

In realty, however, the whole thing was a carefully orchestrated scam designed to take advantage of distressed and anxious homeowners hoping for a loan modification. Luckily, this homeowner contacted Rogers Law, and Rick has in turn not only reported the scam to the Illinois AG’s office who is now investigating the incident, but he also took steps to turn this around for the homeowner… and I’ve contacted Bank of America to let them know what transpired.

At this point, a happy ending seems within reach, but it didn’t have to go that way, so homeowners are advised to exercise extreme caution before sending money to anyone who is claiming to offer a loan modification.

Rick Rogers offers the following advice to homeowners: “If you get an offer for a loan modification, contact the bank at a different number than that shown on the offer letter you receive. Either use the telephone number from an old mortgage statement, or Google “Bank of America Mortgage Assistance” and call that number. Your bank will provide the details of any current loan modification offer, if there is one. And if you learn that there is no “real” loan modification offer, contact your state’s Attorney General’s office immediately.”

But, Rick also had the following to say about loan modifications today…

“It is often said that if something seems too good to be true, it probably isn’t true. But, today… that’s not always the case when it comes to loan modifications, many of which have been spectacular over the last couple of years. So, don’t ignore that spectacular loan modification offer just because it looks too good to be true, just make sure you call your bank (at a number not on the offer letter) and verify the terms before sending any payments anywhere.”

I can no longer keep up with or even count the number of loan modification and related scams I hear about every week. It’s beyond shocking and the price tags on these scams is going up all the time. In 2010, homeowners would tell me about being scammed once or maybe twice for a total of $5,000… or maybe $7,000. Today, I hear about homeowners being scammed four and five times and the total amounts lost can exceed $40,000.

The tragic thing about these scams is that they almost always go unreported for several reasons. For one thing, it often takes months or even years before the homeowner realizes that he or she has been the victim of a scam and by then it just seems hopeless to even try to do anything about it. For another, many people don’t want to admit that they are in foreclosure or that they were taken advantage of, so they just chalk it up to a lesson learned. And for a third, some don’t know who to call to report such a crime. (The answer to the last question is that your state’s Attorney General office is an excellence place to start.)

The dynamics involved in the foreclosure crisis and getting loans modified are bad enough, but the prevalence of scammers, some of whom appear to be legitimate law offices, is making the impact of the crisis that much worse.

In fact, I’m no longer certain which threat poses the greater danger… the servicers who continue to mistreat borrowers in the loan modification process, or the scammers who ultimately cause homeowners to lose homes to foreclosure, in addition to stealing thousands of dollars from people already experiencing a financial hardship.

Still, it has been heartening to see more and more scammers being prosecuted every day, and many are going to spend a significant amount of time behind bars, in addition to the judgements for monetary damages that are commonly in the millions. The Consumer Financial Protection Bureau (“CFPB”) is certainly doing more than has been done in the past, and that’s a positive thing.

But, it’s still nowhere near enough. And for every scam that gets exposed… there’s a new one created… and they all can sound like the answer to someone in distress. So, whatever you do… be careful out there.

Mandelman out.

And thank you Rick Rogers Law for bring this scam to my attention and for helping homeowner save their homes from foreclosure in the State of Illinois.

Rick Rogers, JD/MBA is the Managing Attorney for the Rogers Law Group, a Law Firm dedicated to Home Preservation via Foreclosure Defense, Loan Modification, Mediation, and Bankruptcy. He has instructed hundreds of attorneys across the nation on HAMP and Loan Modification Best Practices. He may be contacted at rrogers@therogerslawgroup.com or through www.therogerslawgroup.com.

Rick Rogers is also the Mandelman Matters Trusted Attorney for the State of Illinois. Get to know him and his firm better by watching the 10 minute video below.