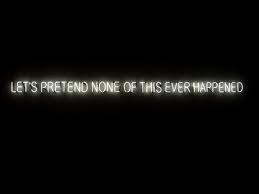

Hey Everybody� It�s �Pretend You�re Surprised About the Economy Day!�

You know, some people like Christmas, others Thanksgiving… still others are partial to The 4th of July, I suppose. But my favorite special days of the year are fast becoming the “Pretend Your Surprised About the Economy Days!” which I suppose are sponsored by the Obama Administration in conjunction with the United States Treasury Department, underwritten by the Federal Reserve.

Here’s how it works… I give you the headline straight out of the news of the day, and when you’re done reading it, you say out loud… “Oh my God, I can’t believe that!” Or something to that effect. Got it? Ready to play? Here we go…

1. U.S. Home Prices Falling Through Floor – Dip-dip-doo-wap-dip-dip-doo-wap-dip-dip!

March’s S&P/Case Shiller Home Price Indices show we’re having a “double dip” in U.S. home prices. In the first quarter of this year, the U.S. National Home Price Index dropped by 4.2% and that’s after it fell 3.6% in the fourth quarter of last year, while the declining National Index fell by 5.1% in this year’s first quarter as compared with the first quarter of 2010.

They’re saying that we’re back to 2002 housing price levels. Here’s what David M. Blitzer, Chairman of the Index Committee at S&P Indices had to say:

“This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011.”

“Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities – Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland, and Tampa – fell to their lowest levels as measured by the current housing cycle.”

“The rebound in prices seen in 2009 and 2010 was largely due to the first-time home buyers tax credit. Excluding the results of that policy, there has been no recovery or even stabilization in home prices during or after the recent recession. Further, while last year saw signs of an economic recovery, the most recent data do not point to renewed gains.”

NOW YOU SAY: “Oh my God, I can’t believe that!”

See… isn’t this fun? Try another one…

2. Buckle Your Seatbelts, ‘Cause We’re Going Around Again…

The executive chairman of Templeton Asset Management’s emerging markets group, Mark Mobius, who oversees more than $50 billion, has said publicly that yet another financial crisis is INEVITABLE because we haven’t addressed the real causes of the last financial crisis.

Mobius was in Tokyo attending the Foreign Correspondents’ Club of Japan when he told the group:

“There is definitely going to be another financial crisis around the corner because we haven’t solved any of the things that caused the previous crisis. Are the derivatives regulated? No. Are you still getting growth in derivatives? Yes.”

Mobius also explained that the total value of derivatives in the world today exceeds total global gross domestic product by a factor of 10. “With that volume of bets in different directions, volatility and equity market crises will occur,” he said.

The global financial crisis three years ago was caused in part by the proliferation of derivative products tied to U.S. home loans that ceased performing, triggering hundreds of billions of dollars in write-downs and leading to the collapse of Lehman Brothers Holdings Inc. in September 2008.

Mobius also explained that the freezing of global credit markets caused governments to pump TRILLIONS into the financial system to shore up the global economy.

OKAY, AND HIT IT: “Oh my God, I can’t believe that!”

See… it’s more fun than fireworks, don’t you think?

3. Turns Out… Homeowners Who Default on Mortgages Aren’t Deadbeats? Go figure.

TransUnion’s latest study revealed that those who only default on their mortgage are much better credit risks than those who are delinquent on multiple credit accounts. And this held true across all credit scores.

Not only that, but the study failed to find evidence in support of the widely accepted “excess liquidity theory,” which says that those that stopped paying a mortgage during the recession had increased cash flow, and could repay other debts. And guess what else… homeowners in foreclosure performed similarly, IF NOT BETTER, on accounts opened further in the process.

Steve Chaouki, group vice president in TransUnion’s financial services business unit said:

“There appears to be a pocket of opportunity among mortgage-only defaulters that is NOT the result of excess liquidity, but rather the unique circumstances of the recent recession. This new market segment that the recession created is an important one for lenders to understand. They have the potential, today, to be stronger and more reliable customers.”

And, Ezra Becker, vice president of research and consulting in TransUnion’s financial services business unit said it best of all, when he said:

“This recession was unique in that certain consumers who defaulted on mortgages would otherwise be good credit risks. It appears their actions were driven by difficult economic circumstances than by any inherent inability to manage debt.”

NICE AND LOUD THIS TIME: “Oh my goodness, I cannot believe that!”

Okay… I’ll drive from here if that’s okay with you…

4. It Depends on Your Definition of a Double-Dip… and these two guys fit mine perfectly.

GWEN IFILL: A new report out today shows the state of the housing market has grown even more bleak. But what is driving this stubborn downward pressure?

(I couldn’t even guess.)

For that, Gwen turns to Rick Sharga, senior vice president of RealtyTrac, a website that publishes data on real estate and foreclosure trends, and Mark Zandi, chief economist at Moody’s Analytics. If they can’t tell us, no one can.

GWEN: Rick Sharga, are these numbers proof of a double-dip recession, that term we have all feared?

(Very scary term.)

RICK SHARGA: Well, certainly not a double-dip recession in the overall economy. But you can make an argument about the double-dip in the housing market. It just depends on your definition of a double-dip.

(Oh, well thank the good Lord for that. It’s not in the overall economy, just the one I live in.)

RICK SHARGA: Is a 5 percent drop compared to a 20 percent drop a couple of years ago really a double-dip, or is it just a continuation of a downward trend that the market is trying to correct?

(Hey, who’s asking the questions around here? And, which is worse: a double dip, or a continuation of a downward trend? I’m freaking out over here. Which one, Rick, which one?)

GWEN: Mark Zandi, in your opinion, what are the driving factors, to say the two or three big driving factors here?

(The suspense is KILLING me.)

MARK ZANDI: Well, obviously, a 9 percent unemployment rate is a problem. A tough job market makes it hard for people to go out and buy homes.

(Don’t you hate it when economists get all technical like that? What’s he trying to say?)

MARK ZANDI: I think the foreclosure crisis is a very serious weight on the housing market. We have millions of loans in the foreclosure process that are going to go through and are going through to a distressed sale. And those homes get sold at a big discount, a big price cut. And that’s driving prices down as well.

(He thinks the foreclosure crisis is a very serious weight on the housing market. I suppose it could be… never really thought about it.)

MARK ZANDI: And confidence — if you look at the consumer confidence numbers, people are still very nervous and scared. And, of course, nothing takes a higher level of confidence than signing on the dotted line to buy a home. So, if people aren’t feeling really good about their financial situation, that’s going to be hard on the housing market.

(Damn it, people… we’ve talked about this before. You’re screwing up our economy with your lack of confidence again. Come on… buck up… get confident.)

GWEN: Rick Sharga, what — would you agree with that, and what would you identify as the major driving factors in this?

(Here’s your moment, Rick. Hit one out of the park, show Zandi what you’re made of…)

RICK SHARGA: I think Mark is dead on. I think he’s probably hit the major identifying factors.

(Oh, well… there you have it then. A swing and a miss… Thanks fellas.)

RICK SHARGA: I think one of the exacerbating factors is that it continues to be stubbornly difficult for the average homebuyer to qualify for a loan. We have historically low interest rates, and relatively few people who qualify to get these loans.

(Really? Now why would that be?)

RICK SHARGA: And I don’t think the foreclosure problem can be overestimated.

(Oh, sure it can, Rick… I’m quite sure you can overestimate anything.)

GWEN: Mark Zandi, you talked about confidence. I wonder if that’s not affected when we talk about these foreclosure numbers. People look at how badly this all went after the bubble, and they think to themselves, you know, I don’t really need to own a home anymore. How much of that is playing a part in this?

(Yeah… Bubble, bubble, toil and trouble… I got burned and I won’t down double. With apologies to Billy Shakespeare.)

MARK ZANDI: Well, I think that is certainly playing a role. I mean, I think nobody wants to catch the proverbial falling knife. So when prices are weak and falling, you don’t want to take the plunge, buy a home, and then, of course, lose value six, 12 months down the road. So, it’s a bit of a chicken-and-egg kind of problem.

(Oooohhhh nooooo, a chicken and egg type problem? That’s not good. I think that means it’s unsolvable, right?)

MARK ZANDI: People are very nervous that if they buy today, that the value of their home will be worth less in the future. And it’s probably a deeper longer-term issue as well. Many people are viewing housing very differently than they did in the past.

(Yeah, like in the past, people viewed a home as a place they would live for a long time. Now they view it as a place they’ll get evicted from over the summer.)

GWEN: Mark — Mark — Rick Sharga, is there another vicious cycle here, which is, if you worry that you cannot get a home, if you worry that you can’t get a loan, if you’re worried that you cannot keep a job, that all of that drives lessened demand as well for all these homes clogging up the market?

(I’m not sure. What’s the answer, what’s the answer, damn it…)

RICK SHARGA: You know we recently surveyed potential homebuyers across the country. And the number that jumped off the page at me was that 40 percent of the renters we surveyed said they have decided never to buy a house.

(Must be surveying renters that went to college.)

RICK SHARGA: That number just — just hit me right in the face, because we’re coming only a few years off historically high levels of homeownership, I think almost 69 percent. And the next generation of homeowners, to Mark’s point, 40 percent of them have already opted not to participate in the housing market. So, it’s a frightening number. The only reassurance I can give is that we do know that consumer sentiment has a way of swinging wildly back and forth.

(It does? I swing wildly back and forth? I didn’t know that about me. Live and learn, I suppose.)

RICK SHARGA: So, if we do begin to see job creation, if we do begin to see a return of consumer confidence, if the housing market begins to stabilize, hopefully, that consumer sentiment can swing back toward where we have a more active buying market.

(Is that all we need? Jobs, confident consumers, and a stabilized housing market? Oh, thank heaven. For a minute there, I thought we might be in real trouble.)

GWEN: Mark Zandi… Is this a regional problem that we’re talking about now, or are we talking about a true national overhang, a hangover from the boom years here?

(It could be regional I guess… it’s pretty much contained to the planet Earth region.)

MARK ZANDI: Well, it’s a national problem.

(If you’re in the EU, don’t be insulted by that… it’s not his fault. A lot of Americans don’t really know there are other countries.)

MARK ZANDI: And every corner of the country has been impacted. Prices are down almost everywhere. There are some bright spots, you know, Texas, for example, parts of the Farm Belt. But outside of that, we have seen foreclosures increase, house prices decline.

(I can’t decide… Texas or the Farm Belt… Texas or the Farm Belt… I think I’ll… EAT A GUN.)

MARK ZANDI: So, yes, I think you could — you would consider this a national house price decline. And, in fact, it’s — it’s unprecedented. The — you would have to go back to the Great Depression in the ’30s to find a time when so many markets have suffered such large price declines. So, it is a national phenomena.

(I kind of like that terminology… we could start calling it “The Great Phenomena.”)

GWEN: Well, let me stay with you for a moment because you mentioned the Depression. That was obviously the biggest economic shock that any of us have — had experienced or perhaps our parents experienced. How much of this slowdown in the housing market is going to end up driving the entire economy’s recovery off-track?

(Oooooo… Oooooo… I know this one… Ooooo… Oooooo… she never calls on me when I have my hand up.)

MARK ZANDI: Well, that’s a good question. You know, I think the economy, it is growing. And it can continue to grow without housing, but it certainly cannot flourish. I don’t think this economy really can engage, it can’t create the kind of jobs we need to bring down unemployment in a substantive way, unless housing is headed north.

(I’ll tell you who needs to flourish and head north.)

MARK ZANDI: And in every economic recovery that we have experienced since the Great Depression, housing has led the way. So we need housing. And we need it to come back. I think there are some good things that are coming together. But the longer we have to wait, the more nervous I get about the recovery and the economic expansion.

(Good things are coming together? Which good things are those? Tell us now. And how much more waiting will make him more nervous? I need specifics, I can’t plan my life around his degree of nervousness.)

GWEN IFILL: Rick Sharga, do you see any good things that are coming together? And should they be given by the federal government or by the private sector or the — even state governments?

(Yeah, ’cause the state governments are flush with all that extra cash…)

RICK SHARGA: You know, neither of the government initiatives that we saw last year, either HAMP to suspend foreclosure activity, or the homebuyer tax credit, really had the intended effect.

(How does he know that? What the hell was the intended effect? If I knew the answer to that question, I’d die a happy man.)

RICK SHARGA: In fact, after the second tax credit, sales volume drove — went so far down, that it pulled home prices down perhaps even further than they would have gone otherwise. I think, unfortunately, the remedy to the housing market right now is probably time. We need time to create more jobs. We need time for consumer confidence to come back.

(If I could save time in a bottle… the first thing that I’d like to do… Hey, wait a doggone minute here… the second tax credit pulled down housing prices further than they would have gone without it? The tax credit pulled the prices down… this guy is no economist, I’ll say that for him.)

RICK SHARGA: We need time for lenders to actually feel comfortable enough to start making loans on properties that have values that are stabilizing. And then the market will start to recover on its own. But I don’t see government intervention as being a part of the solution right now.

(No, don’t be ridiculous… absolutely no government intervention… there’s no way that would help. Government intervention only helps banks, and auto manufacturers, and the stock market and big businesses. It doesn’t work anywhere else, everyone knows that. Anywhere else and government intervention just drags prices down… I think I’ve got it now. We just need to give it more time, simple as that. Like in Japan… they’re giving it lots of time… like 21 years… so maybe figure we give it 30-35… would that be enough time Rick?)

GWEN: Is this a way to — is there any way to know whether this is an anomaly for now or it’s a long-term problem?

(For some people, I think yes, but not for Gwen.)

RICK SHARGA: The continuing falling of home prices?

(Do you believe this exchange? He lost his train of thought? No, Rick… she was asking you how long you might remain stupid.)

GWEN: Yes.

(I’m going to chew on glass in a minute.)

RICK SHARGA: I think there’s probably a little bit more to go. I would be interested to hear what Mark said.

(Arrrggghhhhhh… a little bit more? Probably? Rick, you are such a jackass. You don’t really have the foggiest idea how you got here, do you Rick? Did your Mom get you the job?)

RICK SHARGA: But I think we’re very close to the bottom. And, unfortunately, we will probably bump along that bottom for a couple of years while we go through this inventory of distressed properties.

(I think you’re already bumping along the bottom, and you’ve hit your head and now have the IQ of a summer squash.)

GWEN: Do you agree with that, Mr. Zandi?

(Yeah Zandi… does Rick have the IQ of a summer squash?)

MARK ZANDI: Yes. You know, I think the key statistic for house prices are the homes for sale that are distressed that are foreclosure and short.

(Was that even a sentence? Oh Lord, he’s going to start babbling… waiter, check please?)

MARK ZANDI: And as that share rises, prices will fall. Almost the arithmetic of it is that prices will fall. And I do expect the share of sales that are distressed to continue to rise through the end of the year. And so prices probably will bottom out at the end of this year.

(LMAO… what did I tell you? He has no clue what he just said… and, of course, neither do we. “Almost the arithmetic of it is that prices will fall.” He’s a babbling brook. And then he wraps it up with we’ll hit bottom at the end of THIS YEAR? Right after he said that, he was thinking, “Why the f#@k did I just say that, oh well… too late to do anything about it now, maybe no one noticed.”)

MARK ZANDI: And then by this time next year, I think we will start to see some true price stability, some price gains. So, I think we have to get through this last mountain of foreclosed property. And on the other side of it, I think we will be in measurably better shape.

(So, I guess, based on what he said earlier, by this time next year good things will be coming together. We’ll have jobs coming out of our ears… oodles of confidence everywhere, and a stabilized housing market, is that about right, Mr. Zandi… you spineless sycophant?)

GWEN: Mark Zandi at Moody’s Analytics, and Rick Sharga at RealtyTrac, thank you both very much.

MARK ZANDI: Thank you.

RICK SHARGA: Thank you.

(Okay, Clown #1 and Clown #2… back to your padded cells, or wherever the attendant lets you play during the daytime. Orange soda and crackers at 11, so listen for the cuckoo clock… cuckoo, cuckoo, cuckoo.)

So, how is it that Gwen Ifill is interviewing these two potted plants on PBS and I’m donating to PBS during the pledge drive?

5. Today’s FHA Bulletin: MERS Has Impacted Foreclosures in Michigan.

According to Clifford J. Treese on BROKERDIRT’S Real Estate Brokers Discussion Group…

“On April 21, 2011, the Michigan Court of Appeals determined that MERS is not eligible to take advantage of the non-judicial statutory foreclosure process in Michigan because MERS does not own or have an interest in the indebtedness secured by the mortgage, nor is MERS the servicer agent of the mortgage, as required by the statute. Most of the major title insurance company underwriters have ceased issuing title insurance for any properties where MERS foreclosed by advertisement.”

But… according to April Charney…

Bill Hultman, representing MERS, just testified this week that there was NO PROBLEM at all with title insurance as a result of MERS’ involvement in foreclosures. And, this ignores the essential underlying problem that MERS cannot produce evidence of corporate authority delegated to Hultman to appoint the first signer, much less the 20,000 signers that Hultman testified about. (Hultman’s testimony is available online at: http://4closurefraud.org/2011/05/26/)

April also says we should take note that once again, Mr. Hultman promised evidence of the signers’ authority. He said he’d produce the “resolution” authorizing a single signer, but failed to offer to produce evidence of authority to issue that resolution or any other resolution “appointing” a MERS’ signer. In a previous deposition in another case, Hultman agreed to produce the documents showing that MERS gave him authority to issue the signer resolutions, but to-date, it would appear that he couldn’t produce he has failed to produce any such documentation.

April says she would think that if MERS had the docs, they’d be showing them all over town.

“Look, honey… isn’t the Emperor wearing a fine suit of clothes?”

(Don’t worry though because I think Congress may be making the Emperor an invisibility cloak yea as we speak. Isn’t that right, banker-people? And won’t we be surprised… is that what you’re thinking?)

Mandelman out.