HOMEOWNER ALERT: Mortgage Investors Fraud Recovery’s 50-2-40 Program & CFLA’s Quiet Title, Audits and Experts

PRESENTED IN TWO PARTS:

Part 1 – Mortgage Investors Fraud Recovery’s 50-2-40 Program

Part 2 ““ CFLA’s Quiet Title Package, Audits and Experts

A company using the name, “Mortgage Investors Fraud Recovery LLC (MIFR),” in conjunction with a company calling itself, “Group Trust LLC,” appear to be marketing their services to homeowners nationwide, which they describe under the heading: Resolving Bank Loan Fraud for Home and Business Property Owners.

A few days ago, a homeowner who was being solicited by MIFR/Group Trust sent me copy of their seven-page agreement/contract that they require homeowners to sign to obtain their “services,” and after in-depth review, which included consulting with credible experts in the subject matter, I STRONGLY RECOMMEND that NO ONE GET INVOLVED with EITHER of these organizations.

As you will see by reading what follows, their description of what they are offering leaves no doubt in my mind that not only is it a SCAM… but it’s perhaps the most egregious examples of SCAMS that I’ve ever seen, as it CAN be VERY COSTLY to its VICTIMS.

From reading their agreement, it appears to me that best case scenario is that you will lose $6,000 or more, while receiving nothing of value in return. In the worst case, however, you could lose ownership of your property.

Their agreement (that you will find in its entirety below), is referred to as the MORTGAGE INVESTOR FRAUD RECOVERY CONSULTATION AND SERVICES, Commercial / Residential Application and Agreement… and as it says clearly on PAGE 6…

CLIENT AGREES TO EXECUTE A “˜DEED IN LIEU OF FORECLOSURE’ TO GROUP TRUST THAT WILL BE HELD IN ESCROW UNTIL ALL AGREED PAYMENTS ARE MADE AS AGREED.

Should client fail to make any trial period payment in time to be received at least five (5) business days prior to the due date, AND/OR any Monthly Support Payments, AND/OR the Settlement payment, AND/OR signing the final settlement documents then GROUP TRUST shall notify client either by Phone, Fax, Text, Email or U.S. Mail and allow five (5) days for payment and/or signatures.

Should required payment and/or signatures not be received then Group Trust MAY IMMEDIATELY RECORD THE DEED IN LIEU OF FORECLOSURE HELD IN ESCROW EXECUTED UPON INCEPTION OF THIS AGREEMENT AT WHICH TIME BORROWER OR FORMER DEED HOLDER WILL HAVE NO FURTHER RIGHTS REGARDING THE SUBJECT PROPERTY DUE TO FAILURE TO COMPLETE THE AGREEMENT.

~~~

So, that says that if you miss a payment they can take ownership of your property, and even though it would seem very unlikely that a court would uphold their agreement, it would likely take both time and money before a court would rule and you’d be able to get them off of your title, and by that time, you could find yourself in foreclosure.

It’s also worth noting that when they refer the “trial period payment,” it has NOTHING to do with the “trial plan period,” normally associated with obtaining a loan modification. When they use the phrase “trial period” above, they are defining “trial period” as the period of time during which their services are to be delivered, and for which the homeowners are paying.

What follows is how the “opportunity” is described in MIFR’s contract. I’ve broken it down into short sections so it’s easier to see what it says… and doesn’t say, because the first section doesn’t actually say anything.

This opportunity to identify and address fraud related to the origination and handling of your mortgage loan is being made possible through an alliance of various providers of services through a cooperative with Mortgage Investor Fraud Recovery, LLC (MIFR).

MIFR endeavors to ferret out fraud in the mortgage industry and serve home owners by helping them get into and stay in homes for themselves and their families. In doing so MIFR finds providers of products and services to serve its members who share its philosophy and need the various services it offers.

The agreement being offered herein is an example of such a collaboration to resolve the many egregious and unfair business practices of many lenders and their assignees in this country. Should you choose to move forward to enter into an agreement with the below providers any fees you pay will include automatic enrollment into the cooperative.” (The “below providers” referenced are Mortgage Investor Fraud Recovery and Group Trust LLC.)

Your support will enable MIFR to find other ways to serve you and your fellow members. By entering into this Agreement you agree to be added to the mailing, email, fax, text and voice mail list of Group Trust, LLC the program master licensee.”

THOSE STATEMENTS OFFER NOTHING OF VALUE TO HOMEOWNERS. I mean, seriously… my support will enable MIFR to find other ways to serve me and my fellow members?

WHO IS GROUP TRUST LLC?

According to the contract…

“Group Trust, LLC (hereinafter referred to as “Group Trust“) is acting as the exclusive authorized agent of MIFR under a master license agreement to market MIFR’s services, explain its offering, intake potential clients, collect fees and dues, execute liens, enforce this agreement and remit payments to the respective parties who will provide services under this agreement.”

So, Group Trust is NOT A TRUST of any kind… it’s a Limited Liability Company that markets what I would call MIFR’s deceptive, illegal, and entirely fraudulent services.

THE COMPANY’S ADDRESS – The address on MIFR’s contract shows the company is located at “4426-B Hugh Howell Road, Suite 200 Tucker, GA 30084.” But, research shows that the address shown is that of a UPS Store, as you’ll see on Mapquest below… but no mention of MIFR/Group Trust could be found.

THEN UNDER “TERMS OF APPLICATION” IT SAYS…

“Under the National Mortgage Settlement Act, the following is NOT a loan modification, this is a SETTLEMENT based on specifically identified investor’s fraud.”

“A program has been developed to help property owners receive damages due to the fraud.”

“The “50-2-40″ program available through Group Trust, LLC offers a fifty (50%) reduction of the loan on your property BASED upon today’s value reflecting it’s current condition and current market value. The settlement will provide a two percent (2%) interest rate loan of the agreed amount for forty (40) years secured by the property submitted for fraud settlement.”

HERE’S WHAT HOMEOWNERS NEED TO KNOW ABOUT THESE STATEMENTS…

- THERE IS NO SUCH THING AS THE “NATIONAL MORTGAGE SETTLEMENT ACT.”

- THERE IS NO PROGRAM THAT COULD BE DESCRIBED AS HAVING BEEN, “developed to help property owners receive damages due to the fraud.”

- THERE IS NO PROGRAM OFFERING, “… a fifty (50%) reduction of the loan on your property BASED upon today’s value…”

On MIFR’s website, you’ll find the following “Program Overview“ description…

Program Overview

A Program to Help Property Owners Recover Damages Due to Fraud Perpetrated on Their Mortgage Loans

50-2-40 Program Overview

Congress enacted legislation on May 20, 2009 to assist property owners

Public Law 111-21, 111-22

This act is known as the: Fraud Enforcement and Recovery Act of 2009 (FERA)

FACT CHECK: FERA OF 2009

The only thing that’s correct about that description is that the “Fraud Enforcement and Recovery Act of 2009“ (FERA) was passed as of May 20, 2009. However, FERA DID NOT create any sort of “Program to Help Property Owners Recover Damages Due to Fraud Perpetrated on Their Mortgage Loans.” In fact, one key purpose of FERA is stated as follows…

The Fraud Enforcement and Recovery Act of 2009 helps to enforce federal fraud law and to bring fraud charges against criminals especially when the act of fraud is committed against a financial institution. The act made it a felony to falsify documents or paperwork in an effort to secure financial properties in an accordance to fraud law.

As far as homeowners are concerned, that aspect of FERA would only be used to prosecute borrowers who may have lied on loan applications as to their income or other material facts. Other aspects of FERA modified the False Claims Act, extended the definition of “financial institution” to include mortgage lending businesses, and made it easier for the government to prosecute money-laundering crimes.

THE POINT IS none of this involves, “Helping Property Owners Recover Damages Due to Fraud Perpetrated on their Mortgage Loans,” as is stated on MIFR’s website. For the most part, FERA is about beefing up criminal statutes to protect the government and financial institutions from fraud. As far as I can discern, there is nothing in this 2009 Act providing any relief of any description to homeowners, whether they were victims of fraud or not.

MIFR’s CONTRACT GOES ON TO PROVIDE A LISTING OF THE “ITEMS” that are supposedly offered as part of their fictitious “5-2-40 program.” As stated on the MIFR contract/agreement sent to homeowners…

“ITEMS CONTAINED IN SETTLEMENT: Once you contract for our services, diligent research and a detailed fraud audit will be performed on your loan. If fraud is discovered on your loan, notifications will be made and negotiations with the investor will be performed. Once an agreement is reached the settlement offer outlined above will contain or will be negotiated under the following provisions:

- There is no credit check required.

- No proof of income or financial status reporting to the investor is needed.

- This is not a loan modification, it is a settlement.

- The value/loan reduction is non taxable.

- This settlement will not generate an IRS form 1099 to the original borrower.

- The loan can be assumed by a subsequent buyer of the property.

- Any past negative credit reporting against the original borrower related to this loan will be removed.

- Failure to pay as and when due according to the terms of the settlement during this period will “¨result in loss of the settlement.”

I HAVE NEVER HEARD OF, NOR CAN I FIND ANY PROGRAM OR SETTLEMENT THAT WOULD PROVIDE HOMEOWNERS WITH ANY SORT OF RESOLUTION WITH THOSE ATTRIBUTES. To be specific…

There is no credit check required ““ I cannot imagine being able to prevent servicers or lenders from checking your credit report.

This is not a loan modification, it is a settlement – Horse pucky. If it even existed, which it doesn’t, it would be a loan modification.

No proof of income or financial status reporting to the investor is needed ““ This would never be the case, as it would mean that the investor would be agreeing to a settlement with no way of knowing if the borrower can afford to live up to its terms.

The value/loan reduction is non taxable. This settlement will not generate an IRS form 1099 to the original borrower ““ Unless you hear it from the IRS, or maybe your own CPA, I wouldn’t believe it.

The loan can be assumed by a subsequent buyer of the property ““ Not true. Today’s loans are not assumable, and they cannot be made assumable by some sort of settlement.

AND HERE ARE THE FEES FOR THIS SERVICE…

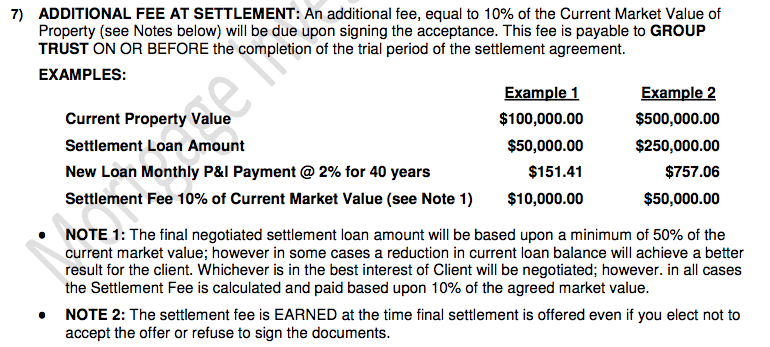

AND HERE’S WHAT IT SAYS UNDER “ADDITIONAL FEE AT SETTLEMENT.”

AND IN CASE YOU MISS A PAYMENT, HERE’S WHAT IT STATES ABOUT REINSTATEMENT…

A one-time reinstatement fee of $1,500 will be due following day FIFTEEN (15) to restart any work after any missed payment if paid within FORTY-FIVE (45) days of said missed payment. Otherwise the file will be CLOSED. Therefore reinstatement WILL NOT BE POSSIBLE and an entirely NEW FEE will be due with the understanding that the ENTIRE AMOUNT of the Application Fee and all Monthly Support Payments must be paid upfront BEFORE any work will commence.

AND HERE’S MIFR’s GUARANTEE (which I would guarantee is no guarantee.)

GUARANTEE: All work detailed herein by MIFR is guaranteed. If for any reason the work cannot be completed, the client will be reimbursed with a full refund of any amounts received from them subject to the provisions of paragraph B above. Any mortgage or note executed by client related to this transaction will be satisfied and released at that time. To insure this provision MIFR has in place a performance bond to insure the guarantee of the refund so stated.

~~~

NEXT… FROM READING A HOMEOWNER’S EMAILS WITH MIFR…

I only learned about MIFR’s program a few nights ago when an attorney sent me information about a homeowner who was trying to investigate their offer’s validity, including a string of emails from MIFR to the homeowner. The emails were from “Regis Sauger,” who refers to himself as “Old Man Regis,” and from Christina Sauger, presumably a relative.

I searched online for Regis Sauger and had no trouble finding him… he’s been involved in all sorts of similar ventures, including being a trainer/presenter for continuing education classes offered by Certified Forensic Loan Auditors (CFLA), including teaching CFLA’s Quiet Title Workshop.

CFLA’s website describes its Quiet Title Package as follows: “CFLA’s “Quiet Title Package” is cutting edge work product developed by the Nation’s Most Well Respected Attorneys in the Foreclosure Defense industry.”

I also found a press release issued by CFLA, promoting Regis Sauger’s Quiet Title Workshop to be held on February 11, 2012. It says, among other things…

Quiet Title Workshop BAR APPROVED CLE” ~ Atlanta, GA with Regis P Sauger

“Presenters Regis P Sauger, Author of “A Quiet Title Course” textbook…”

Understanding Quiet Title is the key to success in fighting illegal foreclosure cases from the bank. This is the ONLY course of it’s kind, and has been approved by The FLORIDA BAR for attorneys to receive continuing education credits (Course ID 86101, 14C.L.E.R.), as well as being approved by the Nevada, Georgia, and Wisconsin Bars, with several other states pending.

The cost for Sauger’s workshop, according to the CFLA press release, was $595 if you registered early, and $795 if you registered at the door.

PART 2 ““ CFLA’s Quiet Title Package, Audits and Experts

THIS IS THE SECOND TIME IN THE LAST MONTH THAT I’VE BUMPED INTO CFLA. CFLA’s website describes CFLA as follows…

Our Business

CFLA is a network of experienced certified forensic loan auditors specializing in the research and analysis needed to provide attorneys and loan modification companies with the Forensic Loan Audits& Qualified Written Requests that they need to even the playing field with Lenders and successfully negotiate (1) Principal Reductions, (2) Interest rate Reductions and (3) Loan Modifications on behalf of their homeowner clients.

Our Clients

Certified Forensic Loan Auditors, LLC has more than 10,000 affiliates and Law Firm clients, serving all 50 States, including Legal Aide Societies, Corporations, Non Profits, and many other organizations that assist homeowners directly.

The last time I wrote about CFLA, I referred to what they offered in a securitization audit in somewhat disparaging terms. Understandably, Andrew Lehman who founded and still runs CFLA, was very upset and he wrote to me demanding that I remove the reference to his company, and threatening legal action if I refused.

I had intended to describe CFLA’s audits as something of questionable value when purchased by a homeowner, based on the overwhelming number of court decisions where the information has proven to make little if any difference to the ultimate outcome. However, since I felt that I hadn’t made my point as clearly as I should have in my article, I removed the reference to CFLA, and let Mr. Lehman know.

I also wrote to Mr. Lehman a few days later to invite him to be a guest on a Mandelman Matters Podcast and/or to provide me with some examples of how his various audits and/or other products and services have helped a homeowner, or lawyer representing a homeowner… but I received no reply.

So, now I discover that Regis Sauger is a CFLA trainer/presenter, and I found a video of his “Quiet Title Workshop,” posted on YouTube and which CFLA still sells for $99 on the company’s website.

It says the CFLA workshop is a: “State Bar Approved MCLE ““ Quiet Title Workshop.” I’ve only listened to the first two hours, five minutes and 58 seconds of the 5:34 hour video, but it was torturous to stay with it that long. In those two hours, I can’t think of even one sentence that would have been valuable for attorneys or homeowners to hear.

What you’ll see during the first two hours of Sauger’s Quiet Title Workshop for CFLA…

Sauger starts his quiet title workshop by telling his audience that IndyMac Bank was sold to One West Bank, and as a result of that sale, the new bank sold a $350,000 home for $175,000, and in doing so they lost $175,000.

But, he explains to the room as he points at his unreadable slide, that the FDIC paid Mr. Soros 90 percent of their loss, so somehow according to his math, the bank ended up making something like $117,000 more than the loan was worth in the first place… and the taxpayers are funding the whole thing, says Regis.

What Regis knows about this subject you could put in a thimble. Nothing he said was factually correct, and I do mean nothing. (I covered the FDIC Shared Loss Agreements back in February of 2014, specifically because of this sort of nonsense, and you can read about why Regis is wrong here.)

He then claims that someone named Bernie, who works at his offices in Florida, has followed his direction on filing quiet title and “has gotten a $330,000 mortgage wiped out, along with a $215,000 mortgage that was wiped out using quiet title.”

“And he’s working on getting his condo free and clear,” Regis says. “If only Bernie was here,” according to Regis, “he could show you the paperwork.”

Yeah, that really is too bad, I thought to myself. Why is it that the paperwork on these sorts of claims never seems to be where it needs to be?

Regis picks out someone in the audience and says, “Robert, you were there with Bernie last time, is that not what he said?” The lawyer verifies that yes, that’s what he heard Bernie say. He didn’t mention anything about the paperwork being on hand last time, however, and I suppress the urge to scream, as I watch no one seem to notice the obvious missing question.

Regis is pacing pensively as he preaches his gospel. “Quiet title simply says that I cannot sell my house because I cannot give a full warranty deed. Therefore I am suing all parties of record.”

He stops and asks his audience, “How do you find the parties of record?”

Several of the lawyers, assuming they are lawyers and not potted plants in suits, jump to answer, “title search” you hear one or two say.

Regis is thrilled at heaving such an advanced class, “All right,” he says. “On a scale of 1-10 this class is about a 9.” He uses hand gestures to show how high the members of the class are on his scale. “You guys are asking great questions,” he says in a flattering tone.

No one seems to remember or care that no one except Regis has asked a question.

That two lawyers bothered to answer his incredibly pedestrian question by saying “title search” makes me wonder what the hell is going on in this class of supposed lawyers. Has someone pumped something that induces mass stupidity into air ducts? How do you find the parties of record, and then glee that one of the attorneys actually knew the answer?

When suing the parties of record, Regis explains, “We’re trying to flush the phonies out of the woodwork.” And what happens if the real party of record shows up in court? Well that’s perfect, according to Regis’ thinking. “Isn’t that what we’ve been trying to do all along?”

I’m totally lost. Is that what we were trying to do? What happened to quieting the title?

He describes a party to the lawsuit coming into court with the mortgage for $400,000… when the house is worth $200,000. “So, what do we do then? We go into the nest room and we negotiate,” he says it as if that part is going to be a piece of cake having something to do with the current market value. He should try that some time… calling a servicer and based on the market value, get them to agree to write down the loan.

“That’s the premise behind quiet title,” Regis says with authority. “Some folks are reading more into it than is there.” He claims that some folks are running around the country saying they’re going to get their house free, but it’s wrong… “it’s a misnomer,” Regis says.

“If you get it free, then it’s a blessing,” he tells his students.

A free house… hmmm… where have I heard of that happening before… wait a minute… it was only a couple of minutes ago when Regis told us about Bernie who couldn’t be here with his paperwork today, and who so far got his $330,000 mortgage wiped out, his $215,000 mortgage wiped out, and is on his way to getting his condo free and clear.

Wow, that’s incredible… Bernie got three blessings out of three. That Bernie person is obviously one blessed dude.

At 1:17 into the workshop video, Mr. Sauger tells his audience of lawyers that “they’re starting to see how CFLA’s securitization audits provide attorneys what they need to bring a quiet title action,” but I couldn’t see why that would be the case because the last 1:17 had been a mix of ridiculous anecdotal stories, misinformation and bad facts.

When I use the word “misinformation” I’m contorting myself into a benefit-of-the-doubt stance on the whole thing, but is it really misinformation? Do Mr. Sauger and/or the CFLA truly not know that what’s being said falls somewhere along the path of useless, wrong and simply uneducated nonsense?

Are they merely misinforming or are they selling magic beans and know damn well that’s what they’re doing.

Then he says the sentence that caused my hair to hurt.

“Now, for those of you that think you can represent yourselves in court on a quiet title action pro se, I’m not going to tell you that you can’t, and I’m not going to tell you that you can.”

Regis has been dispensing legal advice all over the place, but now he draws the line at telling a homeowner whether he thinks homeowners can or can’t represent themselves in a quiet title action? I mean, since he’s not a lawyer, and he’s teaching the class, what do you suppose the message to homeowners is?

But, what’s more disturbing is that this is a class made up of lawyers… and homeowners. It’s like me attending a seminar on arthroscopic surgery… along with a bunch of physicians… that’s being taught by local golf pro.

“I don’t talk B.S. I don’t talk crap. I don’t talk theory,” Regis says, oblivious of the overwhelming irony, because “Crap, B.S. & Theory,” would have been a perfect name for his presentation, but there’s no reason to accept my interpretation of the seminar. Click play on the screen below and decide for yourself.

And after I stopped the video I noticed that on YouTube it says: Regis Sauger, Esq.

No way, I thought to myself. If he’s a lawyer, I’m a marsupial.

I had to find out so I looked him up and found his page on Linkedin. Under education he lists: “St Clement High School, U of D, US Army Security Agency School, Mortgage Broker, Licensed Annuities.” So, maybe anyone can put Esq. after their name?

And here’s how’s he described himself on a site called “Foreclosure Programs for Homeowners.”

About the Author

Regis Sauger is a Licensed Mortgage Broker in Florida. He has written numerous aritlces on consumer credit. He has over 25,000 readers of his articles.

His article on that site is titled: “Foreclosure Defense ““ Strategic Bankruptcy Options,” and if it isn’t offering legal advice or practicing law without a license, then I’m not sure what either of those phrases means. However, for the attorneys that I know are reading this… I know you’ll enjoy Regis’ last paragraph of that article… his closing advice for homeowners, if you will…

“If you are represented by counsel you need to make damn sure he knows what he is doing. Most bankruptcy lawyers don’t know an adversary proceeding or TILA action from egg on the wall. They have no experience with it. Very few lawyers or judges know this area since it only became important in the last couple of years.”

Well then, thank the good Lord you’re here, Mr. Sauger. Since we can’t count on the bankruptcy lawyers or the judges, what would we do without a mortgage broker who has written articles on consumer credit that 25,000 people have read?

The CFLA Forensic Loan Audit…

According to CFLA’s website:

“CFLA is recognized throughout the United States of America as the Leading Experts in Mortgage Securitization and Training. As founders and creators of this industry, we have long set the bar for what to expect in an Auditing Company.”

“… get more information about our Nationally Accredited and Industry Acclaimed “Forensic Loan Auditor Training Certification Classes (3 days). The Nation’s Only Certification Training Class for Auditors in this industry!

“… CFLA Auditors have been admitted as Experts in nearly every jurisdiction nationwide…”

So, after getting to know Mr. Sauger and his MIFR program, and discovering that he was a presenter/trainer at CFLA’s Quiet Title Workshop, I had to see what I could find out about CFLA’s claims about their various audits and experience as expert witnesses. Here’s what I learned…

Searching Westlaw ““ Westlaw’s proprietary database services represent one of the primary online legal research services for lawyers and legal professionals in the United States. Information resources on Westlaw include more than 40,000 databases of case law, state and federal statutes, administrative codes, newspaper and magazine articles, public records, law journals, law reviews, treatises, legal forms and other information resources.

There wasn’t much about CFLA to be found on Westlaw, but I was able to find three cases where CFLA’s audits and/or experts were involved. Two were quiet title cases.

None went well for the homeowners.

1. DEMILLIO v. CITIZENS HOME LOAN – In U.S. District Court in Georgia, on January 29, 2013, Chief Judge Ashley Royal dismissed the case brought by the homeowner, Thomas J. Demillio, and had the following to say about the CFLA forensic loan audit that Mr. Demillio had presented as part of his case:

Having reviewed the Complaint and all appropriate exhibits, the Court finds that Plaintiff has failed to set forth sufficient facts to show he is entitled to relief on any of his asserted claims. In fact, rather than alleging any material facts in his pleading, Plaintiff attempts to “lodge” the facts and statements made in the securitization audit attached herein.”

Frankly, the Court is astonished by Plaintiff’s audacity. Plaintiff requires the Court to scour a poorly-copied, 45″“page “Certified Forensic Loan Audit” in an attempt to discern the basic facts of his case. This alone would be sufficient for dismissal.

However, the Court is equally concerned by Plaintiff’s attempt to incorporate such an “audit,” which is more than likely the product of “charlatans who prey upon people in economically dire situation,” rather than a legitimate recitation of Plaintiff’s factual allegations.

As one bankruptcy judge bluntly explained, “[the Court] is quite confident there is no such thing as a “˜Certified Forensic Loan Audit’ or a “˜certified forensic auditor.’ In fact, the Federal Trade Commission has issued a “Consumer Alert” regarding such “Forensic Loan Audits.” The Court will not, in good conscience, consider any facts recited by such a questionable authority.

And I think that is about the most damning critique of anything that I’ve ever seen a judge write.

2. BARRIONUEVO v. CHASE ““ Another case found on Westlaw that referenced a CFLA audit was a U.S. District Court case in the Northern District of California, BARRIONUEVO v. CHASE, and summary judgment was granted in favor of defendant Chase Bank.

Michael Carrigan prepared CFLA’s securitization audit, and the court ruled that it “does not raise a genuine issue because it cannot be relied upon.” According to the judge in that case…

Mr. Carrigan conducted a search for the Property and Loan using public online databases administered by Bloomberg at the request of the Certified Forensic Loan Auditors, LLC on behalf of Plaintiffs. After conducting this search, Mr. Carrigan prepared a “Property Securitization Analysis Report.”

The record does not indicate the nature of this report or how it was prepared. But similar services offered by the same entity, Certified Forensic Loan Auditors, LLC, describes the process as conducting a search on a Bloomberg terminal to determine whether a loan and the accompanying real property securing that loan has been securitized into a public trust. Mr. Carrigan admits he could not locate the Loan or Property in a Bloomberg search.

Carrigan did, however locate “a prospective REMIC TRUST within the Securities Exchange Commission (SEC) website that matches the characteristics for the possibility of securitizing this Loan.” Mr. Carrigan admits in deposition he was not able to locate the Loan and Property using “loan-level detail.” His assertion that the loan in question was securitized in 2006 is thus speculative.

Chase has produced sufficient evidence upon which a jury could reasonably conclude that the Loan was sold to the Trust in 2006; thus, Chase acquired ownership of the Loan and had sufficient authority to foreclose on the Property.

Wait a minute… if Mr. Carrigan could not locate the loan in any trust, then why would he prepare a securitization audit in the first place? Just to say it could have happened? Well, that’s just ridiculous.

3. BOBBITT v. COUNTRYWIDE ““ In this lawsuit, Plaintiff Brenda BOBBITT sought declaratory judgment, injunctive and equitable relief, and compensatory, special, general and punitive damages. She alleged lack of standing to foreclose, fraud in the concealment and inducement, intentional infliction of emotional distress, quiet title, slander of title, declaratory relief, along with various TILA and RESPA violations.

Chad Elrod, another of CFLA’s “instructors,” and one listed as being a part of CFLA’s Training Academy, has led seminars for CFLA on California’s Homeowner Bill of Rights, on quiet title in New York, on securitization and quiet title in Texas, and in Florida… even though he only graduated from law school in 2008 and is only licensed to practice law in Texas, prepared an affidavit for Ms. Bobbitt.

Westlaw had two foreclosure cases with Mr. Elrod’s name on them as counsel for the homeowner, and in both Texas cases, he filed complaints to stop foreclosure on quiet title grounds. Texas courts dismissed both cases… one was dismissed with prejudice.

So, all told, I think it’s safe to say that Chad has not exactly had tremendous success representing homeowners in foreclosure or quiet title cases, which does make one wonder how many lawyers and homeowners he has stood in front of as the “instructor” in a securitization and quiet title seminar.

Of course, I guess it does prove true the old adage… those who can’t do… teach.

In addition, Michael Carrigan, once again, showed up in this case with another CFLA securitization audit. Chad Elrod also provided an affidavit that was attached to the complaint. And like the first two cases above, it did not go well. The court denied Ms. Bobbitt’s complaint for TRO, injunction and declaratory relief in its entirety.

Referencing the roles of Elrod and Carrigan, the court stated the following:

“Attached to the Complaint is a an Affidavit of Chad D. Elrod of the State of Florida providing an opinion with regard to real property located in Round Rock, Texas discussing the application of Florida law and the failure to record in Lee County.

Also attached is the Affidavit of Facts from Michael Carrigan, of the State of California. Mr. Carrigan provided a Property Securitization Analysis Report for plaintiff. Mr. Carrigan states that he researched the Bloomberg online Database with regard to 1504 Edward Avenue, Lehigh Acres, Florida 33972.

Mr. Carrigan determined that the loan was not identified in any publically reporting trust. He further states that the original amount of a loan claimed by Fannie Mae was $295,000, and the loan may have been securitized because the mortgage and note were separated.”

So, Chad Elrod… of Florida… provided an opinion on a property in Round Rock, Texas… discussing the application of Florida law and the failure to record in Lee County? Followed by Mr. Carrigan who basically said nothing. Seriously?

4. Patricia Rodriguez, Attorney at Law ““ Patricia is another of CFLA’s instructors. She also has been very active representing homeowners. Going back to June of 2012, Westlaw shows her handling 20 cases, (and you can find a list of her cases at that link).

None were any sort of win for the homeowners… in one she was sanctioned by the court and the 19 others were dismissed, many with prejudice or without leave to amend… the three quiet title cases were all dismissed. She also filed a mass joinder lawsuit that was also dismissed.But it’s McGough v. Wells Fargo Bank, 2012 WL 6019108 (U.S. DC N.D. Ca. 12/3/12), that deserves to be highlighted because in this case, Ms. Rodriguez ended up being sanctioned by the court for violating Rule 11 of the Federal Rules of Civil Procedure, and ordered to attend 20 hours of continuing legal education. Here’s what the court said about Ms. Rodriguez…

The Court is disheartened by counsel’s failure in this case, even in responding to the present motion, to recognize that she has erred. If she had approached her practice with a measure of common sense, Counsel might have reconsidered her position…

And on a very basic level, the Court wishes to remind counsel that if an ordinary person cannot understand what she is saying in her pleadings””a neighbor, friend, or family member””then it is very likely that the Court and opposing counsel will not be able to either. The kind of garbled pleading that counsel has three times submitted to this Court imposes a burden that all involved would like to avoid in the future.

Accordingly, the Court hereby orders counsel, Patricia Rodriguez, to attend a minimum of twenty (20) hours of MCLE-accredited legal education courses, apart from any compliance hours regularly required by the California Bar Association. These hours shall include a minimum of eight hours in complaint-drafting or other legal writing, eight hours addressing the substantive law of foreclosure, if indeed it is an area in which Ms. Rodriguez wishes to continue practicing, and two hours of legal ethics training.

And remember that Patricia is a CFLA Instructor, training lawyers and others around the country in how to represent homeowners in quiet title cases and how to use CFLA’s securitization audits in foreclosure defense.

Look, I understand that foreclosure defense has been incredibly difficult even for the most dedicated and experienced attorneys. So losing is not necessarily a bad thing all by itself. But the way CFLA markets the company’s instructors, experts and seminars as leading the industry is at least misleading.

HERE ARE MY THOUGHTS ON ALL OF THIS…

A. In my view, the contractual arrangement that offers the 50-2-40 program being marketed to homeowners around the country by Mortgage Investors Fraud Recovery LLC, Group Trust LLC, and Regis Sauger is nothing less than a crime in progress.

MIFR and Group Trust are clearly scamming homeowners, and should be shut down. The statements made on their contract are false in so many instances, that it’s impossible for me to believe anything positive could be happening there.Feel free to contact me if they send you one of their contracts, and if they hassle you in any way, feel free to contact me immediately. I’m at Mandelman@mac.com, and I can take calls any time.

B. CFLA’s Quiet Title Workshop, at least as taught by Mr. Sauger, is not only worthless to those that attend, but to the degree that it spreads its stupidity to others around the country, it has only caused harm to homeowners… it offers nothing with the capacity to be helpful to anyone with a mortgage that is at risk of foreclosure.

CFLA claims that it’s been approved by state bars for CLE credits, and if true, it only proves that continuing legal education lacks many things, but most of all it lacks… scrutiny.

C. The services delivered to homeowners by Chad Elrod, Michael Carrigan, Particia Rodriguez and Regis Sauger, who are all instructors at CFLA’s seminars, make me question the value of CFLA’s seminars, and the integrity of the company’s CEO, Andrew Lehman.

D. What CFLA’s website claims about their people and their audits, and what can be found out about their performance in the real world are as different as a nuclear bomb and cottage cheese. Am I supposed to believe that Andrew Lehman, the founder and CEO of the CFLA is unaware of this? I hope not… because I don’t.

E. The CFLA site claims that they’ve trained over 1,000 attorneys from all over the country, and unfortunately, that I do believe. It’s not hard for me to imagine that they’ve done a great deal of damage to homeowners all over the country.

Above all, however, what I’ve come to realize is that the only thing missing from CFLA’s website are… success stories.

~~~

To my dear Mr. Andrew Lehman, Founder & CEO of the CFLA…

On your site and Linkedin page it says, “CFLA’s “˜Quiet Title Package‘ is cutting edge work product developed by the Nation’s Most Well Respected Attorneys in the Foreclosure Defense industry,” and I don’t see how that’s even remotely possible.

In addition, here’s a link to CFLA’s promotional video: Mortgage Securitization Auditor Training Program. I love the part where it says that you’ll “receive trade secrets that have made millions for auditors.” That, I totally believe, by the way, but I don’t think it’s a point any homeowner would want to hear.

I feel safe saying that Regis Sauger has no relationship with “the nation’s most well respected attorneys in the foreclosure defense industry,” unless he’s given a couple of them golf lessons, which I suppose is a possibility.

And Andrew, don’t bother sending me another letter telling me how powerful you are, and how you’re going to sue me for whatever you think you can sue me for… I’ve got an idea of how big and powerful you are… and yet, I still wrote this… so that should clear up any questions you might have as to the nature of my response to such threats.

On the other hand, if you want to present any facts that would show me that what you’re doing is actually doing some good, you’ll find me both open and a very reasonable person with whom to converse.

I don’t need much, by the way. How about a couple of cases where homeowners were awarded quiet title when they still owed on their mortgages? Or, how about even one such case? How about any sort of favorable outcome based on the use of your products and services… or based on your experts testifying

Anything, Andrew… can I see anything at all?

Mandelman out.

HERE IS THE MIFR CONTRACT IN FULL:

Mortgage Investors Fraud Recovery & Group Trust Contract