Spire Law Group’s Mass Torte Lawsuit Seeks $43 Trillion from Banks – Former AG Says it’s a FRAUD

Yesterday, the PR Wire was set ablaze by a press release issued by Spire Law Group, announcing their filing of a lawsuit seeking $43 trillion in damages on behalf of a long list of homeowners… and it would appear, the United States Treasury itself. It appears to be yet another lawsuit being marketed to homeowners all over the country as a way to get some justice for the economic catastrophe in large part caused by Wall Street bankers operating in a largely deregulated environment.

They call it a “mass torte,” but it can also go by the name “mass joinder,” or “multi-plaintif,” or whatever other term d’art it might be using tomorrow, but no matter what it’s called, the person calling to tell you about it will say that it’s your chance to make Wall Street pay for their crimes. And the best part is that it only costs a few thousand bucks… and I mean, what’s a few grand when you’re going to be a part of bringing the banksters to their knees? A pittance, I tell you… a mere pittance!

There might even be financing available, and who knows… maybe even layaway. I’m betting they even take credit cards, which if they do is hysterical as it means that some entity like Citibank is getting 2-3% of this deal.

Is this lawsuit for real? Is there really a chance that a court will entertain a claim for $43 trillion in damages?

According to the release…

“In connection with the federal lawsuit now impending in the United States District Court in Brooklyn, New York (Case No. 12-cv-04269-JBW-RML) – involving, among other things, a request that the District Court enjoin all mortgage foreclosures by the Banksters nationwide, unless and until the entire $43 trillion is repaid to a court-appointed receiver – Plaintiffs now establish the location of the $43 trillion ($43,000,000,000,000.00) of laundered money in a racketeering enterprise participated in by the following individuals (without limitation)…”

… and then it lists everyone they say is responsible, including…

Attorney General Holder, Assistant Attorney General Tony West, California Attorney General Kamala Harris, Jon Corzine (former New Jersey Governor), Robert Rubin (former Treasury Secretary and Bankster), Timothy Geitner, Treasury Secretary, Vikram Pandit (recently resigned and disgraced Chairman of the Board of Citigroup), Valerie Jarrett (a Senior White House Advisor), Anita Dunn (a former “communications director” for the Obama Administration), Robert Bauer (husband of Anita Dunn and Chief Legal Counsel for the Obama Re-election Campaign), as well as the “Banksters” themselves, and their affiliates and conduits.

It then goes on to say…

“The lawsuit alleges serial violations of the United States Patriot Act, the Policy of Embargo Against Iran and Countries Hostile to the Foreign Policy of the United States, and the Racketeer Influenced and Corrupt Organizations Act (commonly known as the RICO statute) and other State and Federal laws.”

So, the suit has been filed on behalf of home owner across the Country and New York taxpayers, and it is now expanding into federal court in Brooklyn, New York, seeking to “halt all foreclosures nationwide pending the return of the $43 trillion ($43,000,000,000.00) by the “Banksters” and their co-conspirators.”

Come on… seriously? Am I the only one wondering where are the 14 year-old boys responsible for writing this complaint? It’s time to go home, your mothers are calling you and they sound mad.

Now, I’m no lawyer, thank the Lord… but if you ask me, the whole thing sounds like a plot straight out of an Austin Powers movie, does it not? Stop all foreclosures until you return the $43 trillion you stole? Do you suppose these guys are expecting the following in response…

“Okay, you caught us. Here’s the darn $43 trillion. Now can we please start foreclosing again? Pleeeeaaase?”

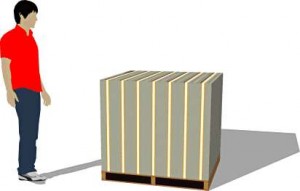

Does the world even have $43 trillion in currency? What would it look like? Well, here’s what a million dollars would look like, courtesy of the site, www.pagetutor.com…

And here’s what a billion dollars would look like…

Are you ready? Want to see what one trillion dollars would look like? It’s one million million. Here you go…

And just in case you can’t see it close enough, those pallets are double stacked.

So, this lawsuit says all foreclosures must stop until 43 times that amount of money is returned? Well, alrighty then, but I think you’re going to need a bigger boat… as in, I don’t know how many aircraft carriers. Like, could the entire U.S. Navy even ship that amount of money back from wherever it is now?

And that’s another question I have about this amount of money… where is it exactly? In the banks? Not a chance. In terms of physical currency, according to www.visual economics.com, the U.S. only has about $853 billion … that’s a far cry from $43 trillion. Oh well… maybe these lawyers are okay with the banksters paying by check.

It occurs to me that $43 trillion sounds like more than you’d be able to sue Adolf Hitler for if trying to get compensation for WWII. I mean, 6 million Jews were killed during WWII, and I don’t know how much the average Jew is going for these days, but even if you got a million a piece you’d only get $6 trillion.

And how did they arrive at $43 trillion… forty-three? I understand rounding it off to the nearest trillion, but why not call it forty trillion and leave it at that?

And that’s not all, folks…

That’s not even all the lawsuit is seeking. The plaintiffs also want an audit of the Federal Reserve and “audits of all the bailout programs by an independent receiver such as Neil Barofsky, former Inspector General of the TARP program who has stated that none of the TARP money and other ‘bailout money’ advanced from the Treasury has ever been repaid…”

So, since I know Neil personally, I sent him an email to see if he knew anything about the lawsuit and whether he would be interested in taking the job as “independent receiver.” I also wanted to make sure he actually said that “none of the TARP money and other bailout money,” was ever repaid… because I didn’t think he had said that. I read his book twice and listened to it two more times on my iPod, and I couldn’t remember him saying that. Here’s Neil’s response… and I’m quoting him word-for-word…

“Ugh. I hadn’t seen this, and no, I never said that. As for the job, been there, done that!”

LOL… he’s funny for a Special Inspector General, don’t you think? But, I think his response makes his position on this topic quite clear. He had me at “Ugh.”

And because I’m not an attorney, I also emailed out a copy of the complaint to roughly 30 of the top consumer law and foreclosure defense attorneys around the country asking for their takes on the lawsuit. After a couple of hours passed, I emailed one of the lawyers, Nathan Fransen of Corona, California, a second time to ask if he had anything I could include in this article. He replied…

“Not yet… I’m struggling to find the proper synonym for ‘blood-sucking parasite with almost enough legal acumen to fill out a form at the DMV.'”

Alabama foreclosure defense lawyer Nick Wooten also weighed in almost immediately…

“The press release is sufficient to scare me away with hair on fire. Looks like some Neil Garfield types ruining amok right up to the sanctions hearing…”

Nick has a way with words, I’ve always thought.

Phillip Swagel was the Chief Economist at the U.S. Department of the Treasury under Treasury Secretary Hank Paulson, during the last two years of the Bush Administration. I sent him an email also to get his take… he said:

$43 trillion. Hard to take this seriously!

Florida foreclosure defense attorney, Matt Weidner also had more than a few words to say about this lawsuit…

“Attorneys that represent consumers and families in crisis have a heightened ethical and moral responsibility to ensure they are serving the interests of those individual clients above all else. My examination of the Abeel lawsuit convinces me that the interests of these very vulnerable consumers are not being served and that many will indeed find themselves in demonstrably more compromised positions because, by engaging in the pursuit articulated in this lawsuit, they will not be protected where they need to be…in their own individual cases.

As an attorney and as a member of the larger community of Americans dedicated to finding real solutions to the difficult legal, financial and societal conflicts we face in this nation, I call upon our state Attorneys General and the federal judge charged with adjudicating this case to expeditiously review the claims and the issues framed in this complaint, give the parties who are prosecuting this case the opportunity to explain their claims…then immediately issue opinions and take action to sanction those responsible when it is determined that the pursuit of this action causes harm to consumers.”

But I still wanted more. This lawsuit is being marketed in Ohio, so I figured who better than Ohio’s former Attorney General Marc Dann to comment on the $43 trillion lawsuit. And you can hear what he had to say in just 10 minutes on this Mandelman Matters Special Report Podcast… Click play and make sure your speakers are turned up…

Just so everyone is aware, “Spire Law Group,” is a name change from the firm, “Mitchell J. Stein & Associates,” a California law firm that was shut down by California’s Attorney General in conjunction with the California Department of Justice and the State Bar of California. Here’s what is says on Stein’s Website:

“As of April 2012, the California Secretary of State and the California State Bar, ratified and approved the name change of Mitchell J. Stein & Associates LLP to Spire Law Group, LLP The firm is now known as Spire Law Group LLP.”

The same site also verifies, or rather boasts, that Stein is behind this $43 trillion extravaganza…

The firm (Spire/Stein) has now – in April 2012 – filed suit in New York against thousands of offshore entities formed since 2009 to launder home owners’ money for federally chartered bank servicers. If you own a home in the U.S. and took out a loan between 2003 and today, the laundered money likely includes your money, as to which you may have rights to damages and injunctive relief.”

Oh dear God… they’ve got my money laundered offshore? That would really be something considering that I never had any money to begin with. How much could they possibly have gotten from me? And why bother laundering it? I sure hope they had it pressed and folded too, I hate wrinkled bills don’t you? Okay, so bring on the injunctive relief.

How much should I write the check for in order to get my laundered money back? Make it out to Spire Law Group? Or should I save some time and just write it to: www.Money-I-Set-on-fire.com? No problem. It’s in the mail, pal. Thanks for letting me know about the scheme to launder the money I never had.

Stein, among others, was accused of “fraudulently taking millions of dollars from thousands of homeowners who were led to believe they would receive relief on their mortgages.”

From the CA AG’s Press Release of August 2011…

“The State Bar has seized the practices and attorney accounts of the attorney defendants:

The Law Offices of Kramer & Kaslow; Philip Kramer, Esq; Mitchell J. Stein & Associates; Mitchell Stein, Esq.; Christopher Van Son, Esq.; Mesa Law Group Corp.; and Paul Petersen, Esq.”

In that release, California Attorney General Harris said…

“The defendants in this case fraudulently promised to win prompt mortgage relief for millions of vulnerable homeowners across the country,’ said Attorney General Harris. ‘Innocent people, already battered by the housing crisis, were targeted for fraud in their moment of distress.’

And here’s the transcript of the proceedings in California… Stein’s testimony is worth the price of admission…

Hat tip to two readers Toni and Julie…

From Spire’s website:

“Spire Law Group, LLP, California State Bar Registration Number 54393, is a national law firm with lawyers across the country, whose backgrounds include the historical provision of legal services to some of the world’s largest international corporations, as well as to some of the Country’s most important governmental and regulatory agencies.”

From State Bar website:

Marjorie Ellen Reed – #54393

4/18/1999 Resigned

12/31/1997 Inactive

12/14/1972 Admitted to The State Bar of California

And finally, there is NO Spire Law Group LLP registered with the California Secretary of State… NO corporate registration either. And as Julie points out, the Spire site lists no attorneys/addresses in other states.

Me thinks the gig is up…

~~~

In large organizations it’s well understood that when information and communication is lacking, the following occurs…

- In the absence of information, rumors spread.

- When rumors spread, morale begins to plummet.

- Resentments form based on false information.

- Creates uncertainty that leads to stress and conflict.

- Harms teamwork, creates factions.

If you’re not already seeing these effects in our society, then you’re not looking closely enough. And the problem with these things taking hold is that they only make it that much harder on those struggling to get through the crisis.

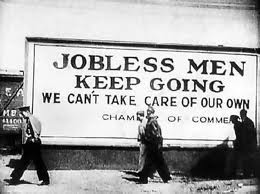

The fact that many are happy about this suit being filed is a reflection of a society that has lived thorough such a terrible time, and seen things happen that were so hard to believe, that many no longer know what to believe. I don’t know how we’ll make it through the next 3-4 years as another 4 million American homeowners face the horror of losing their homes to foreclosure, but I fear that this crisis is cutting scars in the fabric of this nation that will be visible for decades to come.

And for that, I have only tears…

Mandelman out…

Lawsuit Seeks $43 Trillion From Banks