Mandelman’s Monthly Museletter – Version 16.0

Okay, so here’s the next installment of Mandelman’s Monthly Museletter, which I’ve decided I post whenever there are a bunch of things going on that need to be put into proper perspective, but there’s just no way I can write individual articles on each because to do so presents a serious health risk. Capisce? So, without further delay… here’s Version 16.0… it’s the DECEMBER EDITION, hence the festive photo above and throughout.

1. Robo-Signing KILLS…

First the facts of the matter, as reported: Tracy Lawrence was only 43 years old when it appears she took her own life after blowing the whistle on a foreclosure scheme involving “robo-signing,” which was implemented by a company used by most banks when repossessing homes, Lender Processing Services (“LPS”), based in Jacksonville, Florida. According to KLAS-TV in Las Vegas, Lawrence admitted that she had fraudulently notarized about 25,000 documents as part of the fraudulent foreclosure scheme.

Lawrence blew the whistle on the LPS operation in which title officers Gary Trafford, 49, of Irvine, Calif., and Geraldine Sheppard, 62, of Santa Ana, Calif. allegedly told employees to forge their names and notarize the signatures on tens of thousands of default notices from 2005 to 2008, which were used to initiate foreclosures, according to the Nevada AG.

Two weeks ago the State of Nevada charged Trafford and Sheppard with 606 counts of offering false instruments for recording, false certification on certain instruments and notarization of the signature of a person not in the presence of a notary public. You can read the indictment here: Nevada Robosigning Indicment 11-16-11

The Nevada AG’s office sent investigators to Lawrence’s home after she didn’t show up for her sentencing on Monday morning. And here’s the fact that caused me to pause… she would have faced up to a year in jail and a possible fine up to $2,000.

Now, my views on this story: Am I being asked to believe that Tracy Lawrence took her own life because she might have been sentenced to up to a year in jail and a perhaps fined two grand? Because if that’s what I’m supposed to believe… well, I don’t. And yet the fact remains that she’s dead, and it certainly appears to be suicide. I also don’t believe that she was overcome with guilt at having done what she did and that’s what caused her to take her own life. Nope, I’m not buying either of those explanations.

The other thing I don’t like about the way the story has been reported is that LPS is mentioned sort of secondarily, as if Trafford and Sheppard were committing their crimes independently… like rogue employees… and that LPS had nothing to do with it. And that is simply pure, unadulterated crap. Robo-signing, as these crimes are euphemistically called, went on all over the country… all the major banks were involved, as were LPS and other vendors used in the foreclosure process. It’s obviously anything but an isolated incident… plainly, as practices go, it is ubiquitous. (And you know what they say about ubiquity… it’s everywhere.)

Did LPS know about the rampant robo-signing? Of course they did. Someone had to produce the documents for her to sign them, right? Did the banks know it was going on? Of course they did. Did the CEOs of the banks know what was going on? Of course they did.

Look, I spent twenty years working as a consultant for large corporations at the C-Suite and senior management levels, including several of the TBTF banks, and I’m very familiar with their corporate cultures and operations. No mid-level manager at JPMorgan, for example, made a call to start committing fraud and forgery. Why? Because there’s be no reason to do so, that’s why. Faced with the problems that robo-signing addresses, any mid-level manager at a Fortune 500 company could and would simply kick it upstairs for a decision. There just wouldn’t be any upside to trying to handle it alone.

A First Vice President at Bank of America once told me the following story about the path to advancement at the bank. He said that when you take over a department, as long as you don’t change anything, you’ll move up regardless of how your department performs. But, if you so much as changed the brand of pencils ordered by that department, and then the department performs poorly… you’re fired. Now, I understand that the story is an exaggeration, but it’s an exaggeration to make a point.

The people that work in giant organizations like JPMorgan are not entrepreneurs, if they were they’d be starting their own businesses. Consequently, they are not the type to go around attempting to solve problems not of their own making, and for which they would receive no reward, especially when you realize how easily the issue can be kicked upstairs.

Lastly, robo-signing is not a solution that exists on a list that contains other solutions. In other words, if you’re a giant financial institution, and you chose robo-signing as your solution, it’s because you didn’t have anywhere else to go. For example, you didn’t say to the others at the conference table, “Well, we could solve the problem by doing XYZ. But, no… lets go with the fraud and forgery idea instead.”

Now, as to why robo-signing only seems to be a serious prosecutable crime in the State of Nevada? Why, hat’s a darn fine question with which few in positions of power seem to be concerned. Of course, the question of MERS assignments, or even the question of proper legal standing seem to be the same sort of thing… in some states it matters, while in others it doesn’t.

Frankly, I’d be fine with it either way. If many of our current laws governing the transfer of property don’t matter and aren’t going to be enforced then let’s get rid of them. Just change the existing statutes to reflect our new definition of acceptable practices as related to foreclosure. You don’t need standing, anyone can sign off on any required document as long as their boss say it’s okay, and nothing needs to be recorded. If you receive a foreclosure notice from your bank, the only thing to do is pack your stuff. You see? Problem solved.

So, why did Tracy Lawrence take her own life? Obviously, I couldn’t know for sure… but it also seems obvious that LPS is a very large and very powerful company with employees all over the country, and Tracy blew the whistle. I don’t believe she was so scared that she might be sentenced to under a year in jail and up to a $2,000 fine, especially because as the whistle blower, she may have been sentenced to neither. Nor do I believe that she was overcome by guilt at having fraudulently signed and notarized documents used to foreclose on people’s homes because it wasn’t her idea… she was told by her employer to do it.

But I do believe that she was scared of the repercussions for her having blown the whistle on LPS … in fact, I believe she was scared to death as to what the rest of her life would be like having turned on LPS and the largest financial institutions in the world. And I also believe the Nevada AG should indict LPS or do whatever is necessary to put them on the stand, answering questions under oath. Because there is no doubt in my mind that Tracy Lawrence’s death is on their collective hands.

2. OCC proposes credit rating duties go to banks – A real conversation with a banker-friend of mine.

Okay, so I might as well admit it… I do happen to have a few friends that are bankers. They’re evil, of course, but it doesn’t make them bad people. Well, actually it might… but they’re friends anyway. I’ve also got a number of regular readers that are bankers, although I’d never give away their identities… if anyone knew they were reading me, they’d likely be killed. One such senior executive at a major bank told me in an email that reading my column is her guilty pleasure… LOL.

So, you probably saw that yesterday Standard & Poors reviewed 37 banks, downgrading 15 of them, including the six largest U.S. banks each by one notch. JP Morgan Chase went from A+ to A; Goldman Sachs, Bank of America, Morgan Stanley and Citigroup were downgraded from A to A-; and Wells Fargo was cut from AA- to A+. S&P said that it was applying some new standards to its rating methodology that “focus on how institutions manage their businesses under market and economic stress.”

Now, you might be thinking… oh, big deal, who cares? But, to give you an idea of the impact, in a regulatory filing, Bank of America said that a downgrade of one level would mean that the bank would have to post an additional $5.1 billion as collateral. If you remember how credit default swaps, then you already understand what that posting of additional collateral means… if you don’t, however, then perhaps you could use a refresher course at Mandelman U, where complexity we eschew… lol.

So, although I hadn’t seen the story yet, I was on Facebook last night and a banker-friend of mine popped up in a chat window to deliver the good news. Apparently, the bank-friendly site, HousingWire ran a story that caused his little banker heart to go all aflutter. The headline is probably enough to make you throw up, it definitely was for me: OCC proposes moving credit rating duties to banks.

Yes, you read that right… if you don’t like being downgraded, no problem. Just get your regulator to issue a proposal that says that you’ll be rating yourself from now on… that oughta’ fix the problem, right? I’m thinking of doing the same thing, because frankly… the whole FICO thing often pisses me off too. Why let Experian or Equifax rate me… surely I know me better than they do… and I’ve given myself an 850… so approve my loan, betch.

Here’s how the HousingWire story described the proposed new rule:

“The rule, when finalized, would effectively eliminate references to credit ratings agencies in OCC regulations, as required under the Dodd-Frank Act. These firms came under fire after the financial collapse in 2008 for rating many securities, particularly those backed by faulty mortgages, as high as AAA. In the years since, the credit rating agencies have been downgrading billions of RMBS deals.”

Yes, well I can see how those pesky downgrades could get annoying. And as bankers, I suppose you are the best possible choice for rating your own crap… I mean, securities… especially if we want to completely destroy whatever is left of our global financial markets.

So, I was going to write a bunch of snarky stuff about how it’s inconceivable that we would allow such a rule to become a reality, but then… like I was just telling you… this little pop-up chat window appeared on my Facebook page and my banker friend was all excited to deliver the obviously outstanding news. We got into a texting conversation, and when we were done, I thought to myself… why not just post the conversation as my article on the topic, and if you want more, just click the HousingWire link above and you can read it for yourself. I’m not recommending that, by the way, it just gave me a stomach ache, but it’s your call, of course.

So… here it is in its entirety… my real life conversation with a banker on the proposed new rule and a few other things as well. He’ll probably read my blog later today and go into cardiac arrest, but don’t worry LUCY… not his real name… no one could possibly know it was you… I’ve got over 3,000 Facebook friends and more than one or two are bankers, believe it or not.

I think you’ll like it…

BANKER: Woooo-hooooo – Now us banksters get to assign our own credit ratings! No sense greasing rating agency palms–might as well do it ourselves!

MANDELMAN: What? Did that happen today?

BANKER: Careful, my FB blood pressure app is registering an elevation…

MANDELMAN: LOL… banks should be public utilities.

BANKER: “A” to the 4th is called biquadratic – much more scientific sounding. Public utilities have done so well, haven’t they? Did you see LV robo-signer found dead on eve of sentencing.

MANDELMAN: Yes, I’m writing about it tonight.

BANKER: FYI – Retired OCC staff are like GS alumni infecting the executive ranks of major banks; we have several very senior managers that retired from the OCC.

MANDELMAN: What are implications of that?

BANKER: Mostly, I’m just saying that nothing changes… that the change agents don’t exist. New DNA/blood does not come from outside to strengthen the gene pool. They’ve seen what they’ve seen and will act according to their predispositions, experiences which were successful at regulators.

MANDELMAN: Got it.

BANKER: Not deep-thinkers; a little weak-willed — don’t like to offend others, don’t like to buck the trend – political… that sort of thing.

MANDELMAN: Gotcha… sounds encouraging… exactly the kind of people we want running the world.

BANKER: Well, the meek shall inherit the earth, remember?

MANDELMAN: Didn’t a bunch of banks get downgraded today?

BANKER: 37 of ’em reviewed, I think 15 downgraded.

MANDELMAN: Yeah, I’m sure the rest are fine. And so… the answer is to let them rate themselves from now on? Brilliant! I do love the way you guys think. And by “love” I mean “deplore.”

BANKER: Oh, so what? We borrow from depositors for nothing, we borrow from the Fed for nothing. Since we are all downgraded and we have each other as counterparties with the Feds backing, it probably doesn’t matter much. I haven’t read the justification for downgrades – seems counterintuitive to say our debt is riskier, when you consider the level of government support we all enjoy.

MANDELMAN: Yeah, and Europe is too far a flight to make any difference, right?

BANKER: Europe, schmeurope… makes the dollar stronger – Yay!

MANDELMAN: LMAO! Here, here! Clearly, I haven’t been looking at this correctly.

BANKER: Besides, GS can go over there and advise them on how to get out of the trouble they’re in because of them. Just means more jobs, more bonuses… Yay again! And European vacations might become cheap. Mandelmanissimo can buy an Italian villa!

MANDELMAN: Another very solid point. I definitely was not looking at it right.

BANKER: See – you need banker schooling. It isn’t about the cool-aid you drink… you need single malt scotch, cuban cigars, shiny wing-tips, an inability to feel empathy, an air of total superiority, and the belief that you can outsmart anyone else creating and harnessing the next financial weapon of mass destruction. You gotta breathe Gordon Gekko.

MANDELMAN: Of course it probably helps to have the Federal Reserve’s checkbook and credit card.

BANKER: Hey, “you” gave it to us. You gotta’ be the parent/adult and draw the line. You can use your forum to make the populace understand.

MANDELMAN: I’m working on that.

BANKER: I’m all for a coup d’etat.

MANDELMAN: Shall I order you a torch or are you more the pitchfork sort?

BANKER: Marginalize us… return us to the 99%… take away our social standing as the aristocracy. Oh, you’re a legacy? No, your gene pool no longer belongs here in positions of power and authority. We want rational thinking, enlightenment, selfless behavior – you were elected to act on behalf of the population – 5 year no-compete clause with private industry – go back to law and write up some wills, divorces, trusts… try a Accident/Injury practice. And no automatic pension for 1-termers.

Ya’ll (Nomi, Yves, Abigail, Max, April, et al) ought’a gather at USC, UCLA, etc. for a rally or giant speaking engagement.

MANDELMAN: I’d sure love to host that event… a Mandelman Matters conference.

BANKER: Put a simple slide presentation together, collage like an Apocalypse Now montage… boom-boom-boom… “class war” atrocities… show scale, scope, impact… gotta’ bring the war into the living rooms of America, and show the body bags – it affects all of us. Nothing opinion-based… just the facts, show cause and effect, make FactCheck the AAA rating. BTW, have you thought about a simple video background for your articles to post on YouTube?

MANDELMAN: Yes, I’m working on that too. All it takes is money… why don’t you send me some? How about a no doc, stated income re-fi at 150% of appraised value? It’ll be just like old times, you’ll love it. Wouldn’t want to do anything that’s not professional.

BANKER: I said YouTube not Universal Studios. Just a panorama of North Las Vegas, Phoenix, etc. to use as a background. Maybe snippets of public use video clips that aren’t too far out of context. With you narrating the video… your wife and daughter could be the audience that asks you questions. Obama/Bush can plant journalists to lob softball questions, why can’t you can stage it too? Any chance you could get on NPR?

MANDELMAN: I’d love to… or maybe MSNBC on Dylan Ratigan’s show.

BANKER: Hook up with Whalen and you might have a great shot at it. I don’t think the NAR will be inviting you to their X-Mas party.

MANDELMAN: Oh gee… and I so wanted to hang out with a room full of delusional liars.

BANKER: You might be on the short list to keynote JPM’s X-mas party though. BTW… Occupy LA Raid Happening Tonight, LAPD En Route to Begin Eviction. Live coverage of the raid via Ustream says the raid is slow moving and strategic. Venice 311 tweeted information from an LAPD scanner, which said that 900 officers are currently en route to evict the remaining occupiers and that the LAPD has setup a processing and booking station at Dodgers Stadium.

MANDELMAN: Oh God…

BANKER: Hearing that when LAPD helicopter light is turned off that is a signal for cops to move in. Police clad in riot gear are standing at Broadway and 1st. CBS just stated that they are “working with law enforcement” and are not showing scenes they are “not allowed to show.” Quote from KCAL-9, “We made an agreement with LAPD not to give away their tactics.”

MANDELMAN: Well, good then… about time we did away with that pain-in-the-neck 1st Amendment. They’re just a bunch of whiny hippie types anyway, right?

BANKER: Hey, now you’re talking like the chairman of my bank. Nice to have you back.

MANDELMAN: Sorry, but no thanks. I think I’ll just go back to my work making you and yours look like the destructive, power hungry despots that you are. Besides, I took that vow of poverty when I started blogging, remember?

BANKER: Okay, well… have fun storming the castle! I think I’ll go see which fees I can raise for no reason and without disclosure.

MANDELMAN: Sounds like a gas… I’m sending you a current copy of GAAP for Christmas… figured you’d enjoy a little nostalgia.

BANKER: Yeah… I gotta go too… and FYI — The Fed has demanded capital stress tests by Jan 4th that consider Europe/unemployment, blah, blah, blah. And as a result, many of us bankers have had to cancel vacations for the remainder of year. But, at least we’re getting reimbursed for lost airline/travel spending, so that’s a relief. TTYL…

MANDELMAN: You’re disgusting… text me tomorrow… are you going to make it Christmas Eve? Chinese food on me, as usual.

BANKER: Wouldn’t miss it.

MANDELMAN: Okay, and try not to bankrupt any sovereign nations before then, okay?

BANKER: You’re no fun… c-ya!

MANDELMAN: Mandelman out.

3. PMI Files Bankruptcy – Regulators step in and take over yet another mortgage insurer…

They’re almost dropping like flies… mortgage insurers, that is. The latest casualty is PMI Group Inc. of Walnut Creek, California… a Delaware Corporation whose parent company is PMI Mortgage Insurance Co. whose headquarters are in Arizona. And with all of those machinations in place to avoid paying taxes and no doubt obfuscate whatever else, they still went broke… so, nice job there… don’t you feel silly now?

Now, let me assure you that I could care less about PMI Group, or whatever other holding company is or isn’t involved. The reason I’m writing this is because I found a few of the details involved fascinating. The company’s Chapter 11 bankruptcy petition, filed on November 23rd, showed assets of $225 million… and debt of $736 million as of August 4, 2011. PMI had posted losses for the last 16 consecutive quarters.

I don’t know about you, but to my way of thinking, that makes them irresponsible insurers.

Last month, Arizona Director of Insurance Christina Urias took control of the PMI unit on an interim basis, directing that claims be paid at 50 cents on the dollar. (Wait until Secretary Geithner hears about this, he’s not going to be happy… he hates haircuts, don’t you know.)

Of course, it goes without saying that this is not the first mortgage insurer to fall from grace… Triad Guaranty Inc. stopped selling mortgage insurance policies when it ran short of capital back in July of 2008. A state regulator ordered the company to defer 40 percent of claims payments because of “uncertainty” over whether it could meet its obligations. And Old Republic International Corp. was suspended by Fannie and Freddie as an approved guarantor of loans this past summer when it failed to meet capital requirements.

It seems that these companies do much better when they don’t have claims… so, go figure.

Here’s where I thought it got interesting…

According to data provider CMA, the credit-default swaps that are tied to PMI’s bonds went up in cost after the bankruptcy filing, and the effect may be that that contract provisions trigger amounts owed totaling more than twice the company’s debt. They’re talking about collateral calls associated with credit default swaps again… see how devastating their impact can be, even on this relatively small scale.

So, the cost to protect the company’s debt increased by 0.7 percentage points to 75.2 percentage points upfront, which is roughly twice what it would have cost to do the same thing last June. That means that today, investors would have to pay $7.52 million up front, and $500,000 a year to protect $10 million of the insurer’s debt obligations (read: bonds). If we’re talking about a ten year bond, that would seem a tad pricey, don’t you think? I mean, that means the total cost would end up around $12.5 million to insure $10 million in debt.

4. Citigroup may settle, but federal judge says not Yeti…

Remember the Bumbles, from the animated television classic, “Rudolph the Red-Nosed Reindeer,” starring the voice of Burl Ives as Sam the snowman? You know the one… Rudolph gets tossed out of the reindeer games because of his glowing nose, and he ends up taking off with Hermey, an elf who wants to be a dentist, and Yukon Cornelius, the gold prospector. They run into the Abominable Snowman… the Bumbles… and then they find a entire island of misfit toys. I don’t want to say any more, because I don’t want to give away the ending.

Well, the reason I bring it up is that the Bumbles always scared the heck out of me as a kid, until of course, we learn that he’s really a nice Bumbles who just has a toothache. That’s not the part that scared me though… the scary part was that Hermey doesn’t just want to be a dentist, he fancies himself an amateur dentist… and he actually performs dentistry on the Bumbles… like, OMG. I tell you… it was decades before I could sit in a dentist’s chair without inhaling nitrous oxide… or at least that’s my story and I’m sticking to it. But I digress…

The SEC today reminds me of the Bumbles. They growl and wave their arms in the air as they file a lawsuit against one of the TBTF banks, basically alleging that the bank destroyed the national and even global economy, but then they turn into the most accommodating, if not entirely malleable regulator in the history of regulators, offering to settle the case for relative nickels and dimes, complete with no admission of guilt by the settling bankster. It’s so distasteful to watch that I’d stopped watching.

But, a friend of mine who’s a lawyer, recently brought to my attention what just happened in the latest SEC case, which is against Citigroup… the judge said no way to the flimsy proposed $285 million settlement. It seems that Federal Judge Jed S. Rakoff believes that what’s interest of the public must be considered, and the proposed settlement clearly failed in that regard.

Now, get this… the SEC actually ARGUED in support of the proposed settlement, and part of their argument was specifically that the public interest was not a criterion that Judge Rakoff should consider. Rakoff rejected the SEC’s argument and, citing legal precedent, refused to approve the settlement, and set the date for the trial to commence sometime next July.

Are you digging what I’m saying here? The SEC actually argued that the judge should approve the settlement WITHOUT any concern as to what’s in the public’s interest. I have to tell you… that revelation is, to me, proof positive of a regulatory agency that has so lost its way that it may never be able to find its way home. I mean, were it Citigroup arguing the irrelevancy of the public’s interest as related to the settlement, it wouldn’t faze me a bit… Citigroup, like the other TBTF banksters obviously don’t care about the public’s interests, but what in the Sam Hill is the SEC there for if not to represent… or at least be cognizant of the public’s interests? In fact, how dare a federally funded regulatory agency stand up in court and attempt to convince a judge that the public’s interest should not be a factor in approval of a proposed settlement.

According to the SEC’s website, in the section describing the history of the agency, the SEC was created for two fundamental purposes:

- Companies publicly offering securities for investment dollars must tell the public the truth about their businesses, the securities they are selling, and the risks involved in investing.

- People who sell and trade securities ““ brokers, dealers, and exchanges ““ must treat investors fairly and honestly, putting investors’ interests first.

Okay, so call me crazy, but those two statements make it sound like the SEC is supposed to be concerned with the public’s interests, do they not? And yet the SEC went as far as publicly and proudly proclaiming a settlement that the judge later described as being “POCKET CHANGE” for an organization of Citi’s size… and whether the settlement provided any benefit for the SEC beyond “A QUICK HEADLINE.” And in the judge’s written opinion he said of the proposed settlement: “It is neither fair, nor reasonable, nor adequate, nor in the public interest.”

Keep in mind that we’re talking about allegations that center on Citi’s broker-dealer arm, Citigroup Global Market, for “intentionally misleading investors in relation to a $1 billion collateralized debt obligation known as Class V Funding III.” You know the drill by now… Citi lied to investors, selling them crap, while betting against it on the side.

And in point of fact, it was that very behavior… far more than any sub-prime loans defaulting, that has caused an economic meltdown in this country, and around the world, not seen for more than 70 years. Citigroup’s acts in this regard were the proximate cause behind the destruction of investor trust that has left the U.S. government the lender of first, middle and last resort.

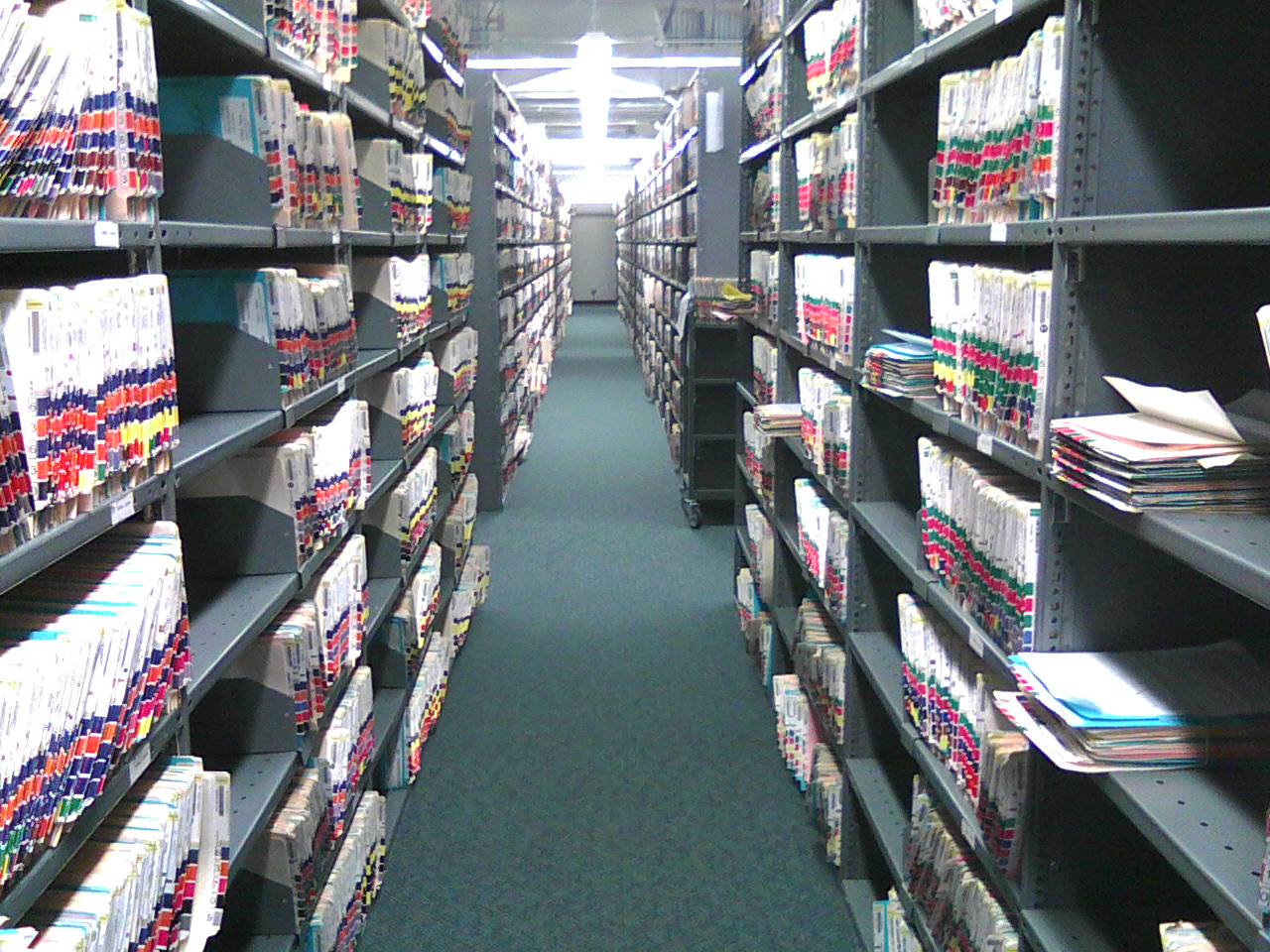

5. Remember that final scene in Raiders of the Lost Ark?

Remember that final scene in the movie Raiders of the Lost Ark… the first one… when the U.S. Government is about to store the Ark of the Covenant and all you see are the rows upon rows of some giant government warehouse where nothing will ever be found once stored. Well, a reader of mine was kind enough to send me a photo of one of the floors at Bank of America’s servicer… it’s where they store borrower files.

I think the photo speaks for itself. Happy holidays everybody!

Mandelman out.