Loan Modifications: 500,000 or 1200? All right… ENOUGH is ENOUGH.

Before I dive into the meat of this commentary, let me make sure that I have things right going in…

It was in the latter part of this past July when the mortgage servicers participating in the Home Affordable Modification Program (“HAMP”) were summoned to attend a meeting in Washington D.C. The administration, the media reported, had recently decided that it was very unhappy with the servicer performance as related to loan modifications, both in general, and specifically related to HAMP modifications, and they were calling the servicers to the table so they could be read the riot act. There was a new sheriff in town and his name was Timothy Geithner.

Right so far? I think so.

After the meeting the statements that came from Mr. Geithner made most people believe that he had laid down the law, telling the servicers that they had better shape up, or else… well, he didn’t specifically say what else, but we were led to believe that he was pissed. He set a wonderfully arbitrary goal for 2009: the servicers, who at the time were reporting that they had helped 200,000 homeowners with HAMP modifications to-date, would have an additional 300,000 HAMP modifications done by the end of the year.

So, the thinking went… Yay!

Within two weeks of that meeting, around August 4th, I believe, the servicer “report cards” were released for the first time. Bank of America, the country’s largest mortgage holder and servicer came in dead last, with Wells Fargo Bank in the penultimate position, scoring 4% and 6%, respectively. Publishing the relative performance of the nation’s mortgage servicers as related to HAMP modifications was supposed to publicly shame these financial sociopaths into doing better.

Within a week or two, I remember hearing the numbers going up almost daily. Within a week, Bank of America announced that it had initiated over 100,000 modifications, as I remember it. Wells, Chase and others released more of the same type of performance numbers, and I remember thinking to myself… “Wow, that’s much too fast. They should be lying slower.”

While attending the California State Bar’s annual meeting, held this year in San Diego, I pointed out to those attending the symposium on loan modifications that sending out letters essentially saying: “Dear Borrower, you may qualify for a loan modification,” should not qualify as actually “initiating a loan modification”. Brilliant insight, I’m aware.

I also pointed out that “trial modifications,” in point of fact, are bullshit. Sorry, but that’s the right word in this instance.

What is a “trial modification”? The Financial Accounting Standards Board, or FASB to those in the know, publishes a regulation, Financial Accounting Standards No. 5, or FAS 5 for short, to address how loans and contingencies are to be accounted for, and nowhere does it say anything about a loan being in a “trial period”. Loans are either “impaired” or they’re not impaired, and basically, if they are impaired, you have to treat them a certain way… place them in a heterogeneous pool of loans and reserve for their expected losses, for example.

Is this what the banks are doing when a loan is said to be in the “trial modification” phase? Or is a trial modification a way of keeping the loan in its performing status and picking up a few thousand extra dollars before foreclosing? I mean… I don’t remember “trial mortgages”? Before they actually give you the mortgage you have to make a bunch of trial payments? Why in the world can’t these giant financial institutions follow the rules and modify a mortgage when it’s in the investor’s best interest to do so? You’d think we were asking them to convince Senate Republicans to support Obama’s health care proposal.

As anyone who knows the real situation related to loan modifications knows… trial modifications are very near meaningless. Homeowners with trial modifications find their homes in foreclosure all the time. In fact, I’m about to write several stories about homeowners who’ve lost their homes after making all of their trial payments as agreed, and one story of a homeowner who was granted four trial modifications by Indy Mac/One West Bank… only to find their home in foreclosure and about to be sold.

Okay, so who cares, right? I’ll get back to the point of the story…

So now, ex-Fannie Mae Chief Credit Officer Edward Pinto has come out attacking Treasury’s claim that 500,000 homeowners have entered the HAMP loan modification program. He doesn’t buy it. In fact, Pinto says that HAMP is rapidly becoming “I will pretend to modify your loan if you will pretend to make the payments.” Lovely… that’s just friggin’ lovely, especially when you consider that HAMP is a $375 billion federal program and one considered a lynch pin to our nation’s economic recovery.

Even though there were 200,000 loans in the trial modification phase as of late July, and even though Secretary Geithner has announced that the industry has exceeded its goal of reaching 500,000 by year’s end, Pinto says that to-date there are only something like 1200 borrowers that have received permanent modifications.

Again… that’s 1200 BORROWERS THAT HAVE BEEN GRANTED REAL MODIFICATIONS. The rest, as my Grandmother used to say, is BUPKES, which is a Yiddish word meaning something worthless, absurd, or stated publicly by Timothy Geithner.

Further, and as if that news wasn’t bad enough, according to Michael Young, Vice Chairman of the Mortgage Bankers Association, 99% of the loan modification packages are incomplete, which has led to speculation that many of the 500,000 will never submit the necessary documentation or otherwise will not qualify.

Okay… time-frigging-out over here. Everyone just stop whatever else you’re doing as you read this. Put your coffee down. Stop opening your mail. Go back and re-read that last paragraph. You know, the part where it says: “99% of the loan modification packages are incomplete”.

Now, I realize that some of my readers don’t agree with my position on the whole loan modification thing. Some probably feel that loan modifications won’t work for whatever reason, others may still hold the view that homeowners don’t deserve to have their mortgages modified, and still others may not be close enough to the situation to have a strong opinion one way or the other. But if this isn’t starting to make any of you realize that we, the American people, are being fed endless lines of unadulterated horse manure… well, then I just don’t know what to say. 99% of loan modification packages are incomplete?

I’d like to say a few words in response to Pinto’s and Young’s assertions: It’s your industry… either do something productive about the problem, or shut the f#@k up.

How was that? Clear enough for you, Mickey? I’m not being too technical, am I? Going too fast for your obviously diminutive brain, Mick? If there’s a God… and I’d like to think there is… then one day soon you’ll be on some sort of panel discussion and I’ll be in the audience. Be afraid, Mickey… be very afraid, because no one gets away with saying things that mind-bogglingly stupid with me around.

If 99% of the loan modification packages are “incomplete,” you jackass, then who’s fault would you say that is, Mr. Vice Chairman? Must be those lazy, good-for-nothing borrowers, right? Or maybe it’s those horrible attorneys or mortgage professionals who charge for their services, but just can’t seem to get it right, even after submitting and receiving approval on literally thousands of loan modifications in the past. Is that what you’re asking us to believe, Michael?

For God’s sake, does that even sound possible to anyone? Does it sound even potentially correct? The only way that 99% of 500,000 loan modification packages submitted could be considered incomplete is if the lenders and servicers are simply coming up with new requirements after the fact… and I have no trouble believing that’s the case. Can anyone imagine ever hearing that kind of statistic about mortgage originations? If 99% of new mortgages had incomplete application packages I wonder what the banks would be doing right about now? Blaming the borrowers? Probably not so much.

Young says the industry is also concerned about an “expected dropout of a sizable number of qualified borrowers who fail to make all the payments required during the trial period”. Is that what the members of the Mortgage Bankers Association are concerned about? Really? That the homeowners won’t make their trial period payments? Boy, I’d love to see the data on that as it comes in, not that it will ever be published, of course.

Young also says that this fear of borrowers not making their trial period payments has been heightened by a concern of some servicers that “borrowers will use the trial period to game the foreclosure process and delay their own foreclosures by another 5 or 6 months”.

Borrowers will “game the foreclosure process” in order to delay their foreclosures by 5-6 months? Are you friggin’ kidding me? Who is likely to game the foreclosure process? The borrowers? The borrowers are going to “game the foreclosure process”? Not the servicers, huh? The servicers wouldn’t try to game anything, right? It’s the borrowers that are gaming the system, don’t you know.

See… that’s the kind of thing that keeps me going. I start to get tired of writing about the enormous lie that is the Obama Administration’s Making Home Affordable Program, and then some servicers come out saying something that stupid… and presto… for me, it’s all brand new again.

Pinto’s math states that ultimately only 100,000 to 200,000 of the 500,000 trial modifications will become permanent, and that assuming a re-default rate of 50%, only 50,000 to 100,000 performing loans will result.

Okay, so this guy’s obviously no math major, let’s just say that, shall we? A difference of 100,000 to 200,000 is a difference of… hmmm… quite a bit… what… 100%? That’s like describing a suspect as being 6-12 feet tall, weighing 200-400 pounds.

And as to Pinto’s re-default rate of 50%… first of all, let’s get something straight for the innumerate Mr. Pinto… 50/50 isn’t a re-default rate at all, it’s a colloquialism that means: “I don’t know.” When something has a fifty percent chance of happening and a 50% chance of not happening, it’s considered by mathematicians to be “RANDOM”. Like flipping a coin… you’ve got a 50% chance of it landing on heads and a 50% chance of it coming up tails.

Of course, as any 11 year-old worth his or her salt can tell you… this doesn’t mean that if you flip a coin 100 times, you’ll end up with 50 heads and 50 tails… in fact it’s highly unlikely that will be the outcome. It depends on how many times you flip it, right boys and girls? Eventually, you’ll hit 50/50, but when someone says the chances are 50%, they’re saying that the outcome is random and therefore cannot be predicted with confidence one way or the other.

Mr. Pinto is likely the kind of guy who would flip a coin 10 times, find it landed on heads seven of those times and then publish the sentence: “In a recent coin tossing study, 70% of coins preferred heads over tails.” Do I have your math skills level nailed down about right, Mr. Pinto?

I know that there were a couple of studies, published by banks and servicers having to do with loan modifications made in 2008, that showed up to a 60% re-default rate on said loan modifications, but they were only taken seriously until we all learned that 60% of the so-called modifications granted in 2008 resulted in higher monthly payments. Once we found that out, we should have called out the industry for being the unabashed liars that they are, but at least those of us possessing fully developed adult brains stopped listening to the fabricated nonsense published by lenders and servicers related to loan modifications.

More importantly, and besides all that, why in the world would anyone assume 50% to be the re-default rate of HAMP modifications? HAMP modifications take into account the borrower’s income and expenses and are supposed to result in a monthly payment that’s no more than 31% of the borrowers gross monthly income, right?

And… Memo to the Mortgage Bankers Association, et al:

A loan modification is when the amount of the borrower’s monthly payment goes down… not up, morons. You know how we can all know that to be the case? Because if I were to line up 10 million American homeowners from coast to coast and ask them whether a loan modification meant that a mortgage payment went up or down, it’s extremely likely that not one single person would check the box marked “UP”. Get it, you slimy, deceitful, manipulative covet of number crunching clowns?

(It seems obvious that the 60% re-defaults came from the unfortunate homeowners who believed the government’s unfounded, irrational and deleterious advice that people should not hire someone to help them get a loan modification, but rather call their bank directly. I say this because there’s not a loan modification firm in the country that could sell their client that getting them a higher payment constituted getting them a loan modification. In fact, having interviewed well over 1,000 homeowners from across the country… and with all having hired a firm to help them obtain their loan modification… I’ve never heard of a single instance where a higher payment was the outcome. Never, not even once. Down right spooky, don’t you think?)

Anyway… so, Mr. Pinto’s ultimate point is that, based on his industry’s obviously highly scientific projections, the Obama Administration’s stated goal, which is to keep 3-4 million homeowners in their homes by modifying their mortgages instead of foreclosing, would require 15-30 million homeowners in trial period modifications. Or, in other words, half a million trial mods isn’t going to cut it, and twelve hundred is one heck of a long way from 3-4 million.

The irony that Mr. Pinto, Mr. Young and yours truly all agree that the Obama Administration’s plan to stabilize the housing markets by stopping foreclosures has absolutely no chance whatsoever of succeeding is certainly not lost on me, nor on you the reader, I would imagine. However, we come to the same conclusion as a result of traveling very different paths marked by very different assumptions along the way.

Mr. Pinto believes that in order to make the program work, we should have more homeowners in trial modifications than there are homeowners at risk of losing homes to foreclosure. Mr. Young seems to think that borrowers being unable to qualify or complete paperwork is the problem.

I, on the other hand, believe that mortgage servicers simply have to stop being the unscrupulous liars and war profiteers they have thus far proven themselves to be, and start modifying loans in the best interests of investors and our nation as a whole.One final question: When does a lender or servicer get paid for a loan modification? When it goes into the trial period? I really don’t know, but the reason I’m asking is that, if only 1200 of the 500,000 HAMP modifications being tossed about in Treasury Department press releases these days are permanent modifications, then we should have only spent like $1.8 million of the $75 billion allocated for HAMP, and I’m guessing that’s not the case.

Although I could certainly be wrong, I suppose. Maybe everything is going just fine… according to plan… A-Okay. I’m just thinking out loud over here…

As Jeff Nielson writes in an article published on SeekingAlpha.com, and I HIGHLY RECOMMEND reading anything he writes in its entirety:

“… at the beginning of this year, when the Case-Shiller index was reporting that the collapse in U.S. housing prices had reached their most extreme level (a year-over-year decline of 19%), the U.S. government was reporting that U.S. home prices were rising.

As with many other U.S. government “statistics”, I now pay absolutely no attention to government housing propaganda. While it is possible to critically analyze mere exaggerations, there is no analytical value to numbers which are simply invented ““ and in direct contradiction with what is actually happening in markets.”

Nielson goes on to point out the absurdity of what we’re all being fed in the form of statistics from our government and “reliable” sources, like the National Association of Realtors (“NAR”). He points out that more than 10,000 American homeowners are entering the foreclosure process every single day and that millions more are only one or two missing paychecks away from joining the club.

As to today’s inventories of homes, Nielson states:

Keep in mind that U.S. banks have been accumulating empty/unsold properties for roughly two years ““ as “distressed sales” have never kept pace with the rate at which banks are accumulating these properties since the U.S. housing collapse began. A conservative estimate is that they are currently holding roughly 5 million empty/unsold units ““ equal, by itself, to a year’s worth of consumption.

Add to that the millions of U.S. homeowners desperate to sell in order to avoid foreclosure, and the return of large numbers of speculators to this market and this represents at least another 5 million units of inventory ““ since speculators don’t buy-and-hold houses, but rather put them back on the market (either immediately, or after some cosmetic changes).

As a result, none of these speculator-purchases remove any inventory from this market. True, in theory, speculators can rent-out the homes they purchase. However, with U.S. housing vacancies already at their highest level in 23 years and still soaring higher, the combination of crumbling rental prices and huge over-supply means that any speculator foolish enough to become a “landlord” rather than simply trying to “flip” properties is doomed to be just another foreclosure victim.

There have been a number of recent reports attempting to “pump” this market ““ which actually claim that buyers are having a hard time finding “distressed properties” to buy. Don’t believe a word of this nonsense.

Here, here. I don’t know about you… but I love this guy…

Ultimately, what this means is that in the real world, there are about 10 million units of “inventory” – which represents nothing more than “REO” homes (those held by the banks), the properties being flipped by speculators, and “distressed” homeowners who are desperate to sell. This estimate excludes any “normal” sellers in the market (i.e. people simply wishing to move to relocate of their own volition).

Thus, the “official” inventories of unsold homes represent less than 1/3rd of actual inventory, and most likely only about ¼. The reality is that U.S. housing inventories have risen to their highest level in history ““ and added millions of units to the 19 million empty homes, which existed a year ago.

When stacked up against real inventories, the sales of only 5 million units this year sets up another nasty “leg” downward for this market by itself. However, as I (and an increasing number of other commentators) are reminding people the second spike in mortgage-resets for the dreaded “ARM mortgages” (adjustable-rate mortgages) is just about to begin.

Can you dig what he’s saying here?

Nielson explains that the next spike in foreclosures, which will begin in earnest in the beginning of 2010, will be much worse than what we’ve experienced to-date. Why? Because the last wave of foreclosures didn’t occur with unemployment levels at their worst in 70 years, or with a “shadow inventory” of at least seven million units over what he calls the “laughable” numbers published by the NAR.

For the U.S. financial sector, this next crash in residential housing comes just as the crash in U.S. commercial real estate has worsened into a crisis of its own. Combine this with record rates of delinquency, which are simultaneously occurring with every other category of bank credit to U.S. consumers, and obviously the losses ahead for the U.S. financial sector will greatly exceed the losses already incurred.

Gee… maybe the whole “recession is over” thing was overplayed… just a bit. Maybe. Here’s Nielson’s advice going forward:

Stay focused on the “big picture” and do not allow yourself to be deceived by fraudulent “statistics”, absurd “spin”, or the occasional, positive “blip” in this market. In even the worst crashes, nothing goes down in a straight line. Given that the U.S. experienced a collapse in its housing market more than three times worse than the worst year of the Great Depression (based on data from the highly respected housing economist Robert Shiller), a “dead-cat bounce” for this market was overdue.

At best, this lull in “the eye of the hurricane” will last to the end of this year. Early next year, the new spike in mortgage-resets will begin. At that point, U.S. banks (who have up until now totally ignored this oncoming disaster) will have to confront this next crisis ““ which will most likely be characterized by the U.S. media as a “surprise”.

By this point in time, there can be no excuse for responsible adults to be “surprised” by developments in the U.S. economy. The same fools and shills who were “pumping” U.S. markets and the U.S. economy at the peak of the U.S. bubble (and Wall Street Ponzi-scheme) are pumping again. Meanwhile, the fundamentals for the U.S. economy continue to deteriorate.

It is only the fact that the U.S. government pretends there is no inflation in the U.S. economy which allows it to pretend that some aspects of the U.S. economy are experiencing a tiny improvement. Even then, most of the statistics it spews are not improvements but simply a reduction in the rate of collapse.

The U.S. propaganda-machine has completely erased this important logical distinction. When the Titanic had already taken on almost enough water to drag it to the bottom of the Atlantic, would rational passengers on that doomed ship really be encouraged to hear that the ship was “only” taking on water at a slower rate – simply because most of the ship was already water-logged?

Of course, I’m no real estate expert, but maybe… just maybe… our government should step in and do something about the crimes being perpetrated by banks and mortgage servicers against homeowners and our nation every day in this country. Maybe, just maybe… they should be forced to help fix the disaster they’re responsible for creating, instead of being allowed to pay themselves billions in bonuses yet again… as if nothing has happened or continues to happen.

Ask yourself this question: What do you think our country will look like after another year that’s worse in every way than the one we’re about to finish… and then after that, another year that’s worse again… and then yet another? Can you imagine what it will be like after two more worsening years… and then it starts to get really bad?

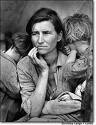

Consumer spending will continue to decline… unemployment will continue to rise… foreclosures, which are already forecasted to hit 12 million over the next two years, will hit the 15 million mark. Our homes… all of our homes will continue to drop in value. How many retirees will find that they are at or below the poverty level, unable to pay for health care, or even basic necessities?

What will it feel like to drive around our nation’s cities after two more years worse than the last? What will our children, now growing up, learn from each other while at school or when playing with their friends? What kind of adults will they be after growing up through years like the ones to come… if nothing is done to force meaningful positive change?

I can’t speak for every homeowner in America… yet… but I personally wonder what our nation’s homeowners are going to be thinking about next year at this time after their property values have dropped another 10-30%, and we’ve seen another 7-14 million homes lost needlessly to foreclosure… only to sit in inventory dragging the value of every home in America further and further down.

Will some still be parroting idiotic things like: “I don’t want to pay for my neighbor’s kitchen remodel,” as the moron, Santelli of CNBC, suggested earlier this year?

We have to stop the madness… we have to stop buying the banking lobby’s propaganda. It wasn’t the borrowers, it was and is the banks, both commercial and Wall Street, that caused this catastrophic state of affairs, and yet they continue to have the greatest amount of influence in Washington D.C. It’s time for the people of this country to say loudly and clearly… ENOUGH!

Can anyone say: “Send home incumbents in the mid-term elections”? I’m thinking that quite a few among us could say just that… and I’m praying that enough of us will say exactly that when behind their respective voting booth’s curtain in 2010.

There should be no question that, more importantly than at anytime in modern history, we need to send a message to those in Congress… a message that says that we the people of the United States of America will no longer be tolerating more of the same.