RealtyTrac’s Blomquist: The Foreclosure Crisis is Well Behind Us. Mandelman: Oh, Shut-up Daren.

According to RealtyTrac’s monthly U.S. Foreclosure Market Report for August 2014, the number of foreclosure filings nationally has increased month-over-month, declined year-over-year… I’m not sure how they’re faring hour-over-hour, or quarter-over-quarter… not that I care one way or the other.

So, how are foreclosures defined this week, according to RealtyTrac? Well, RealtyTrac says foreclosure filings include default notices (which are sent out by servicers)… home auctions (scheduled by servicers)… and bank repossessions of property (also controlled by servicers.)

Are you seeing any sort of commonality in all that?

Foreclosures are defined by the number of notices sent out by servicers, the number of repossessed homes auctioned by servicers… and the number of homes repossessed by servicers.

So, it would follow that if servicers were to stop sending the notices out… put off repossessing homes for a while… and stopped scheduling auctions… according to RealtyTrac’s definition… foreclosures would simply drop to zero.

Would that change the situation related to the number of people losing homes to foreclosure? Would it change the number of loans going into default? The number of people not keeping up with their mortgage payments? No, of course not. According to RealtyTrac, foreclosures are 100 percent controlled by servicers… or another way to phrase it would be… according to RealtyTrac, what borrowers are or aren’t doing has nothing to do with the number of foreclosures.

Am I succeeding at painting any sort of picture here? Borrowers have nothing to do with the number of foreclosures? Am I the only person that sees that someone has his or her thumb on the roulette wheel in this casino?

RealtyTrac’s data showed that 116,193 properties had a foreclosure filing during the month of August alone. That’s about 3,875 homes being foreclosed on every single day in this country. The number represented an increase of 7 percent from July and a decrease of 9 percent from August of 2013… but… so what and who cares? What difference does any of that make?

According to RealtyTrac, 51,192 foreclosure auctions were scheduled nationally in August, and foreclosure led to 26,343 properties being repossessed by lenders that same month. That’s about 1,707 foreclosures auctions scheduled every day in this country, and what am I supposed to think because of that number? Is it good or bad? I don’t know, but it doesn’t sound like a foreclosure crisis that’s over, or ending… I’ll tell you that for sure.

As DSNews reported today, “the number of foreclosure auctions scheduled in August increased by 1 percent year-over-year after 44 consecutive months of annual declines, according to RealtyTrac. Month-over-month, scheduled auctions declined by 1 percent in August. In judicial states, where the foreclosure process must pass through the courts, scheduled auctions increased by 5 percent year-over-year.”

Wow, well my goodness… why didn’t you say so? I’m not sure whether to be alarmed, relieved… or entirely nonplussed.

Thank goodness for RealtyTrac’s vice president, Daren Blomquist. When the news is meaningless, leave it to Daren to come up with a way to assign meaning at the drop of a hat.

“The August foreclosure numbers demonstrate that although the foreclosure crisis is well behind us, the messy business of cleaning up the distress lingering from the housing bust continues in many markets.

The annual increase in foreclosure auctions — the first since the robo-signing controversy rocked the foreclosure industry back in late 2010 — indicates mortgage servicers are finally adjusting to the new paradigms for proper foreclosure that have been implemented in many states, whether by legislation or litigation or both.”

(I cannot tell a lie… I’ve come to absolutely adore Daren.)

That so-called news about August foreclosures… news to which I’d be hard pressed to attribute any significance at all… to Daren’s mind demonstrates that the foreclosure crisis is clearly behind us. And the fact that scheduled auctions went up by one percent or five percent, to Daren means servicers are finally adjusting to new paradigms.

I swear, Daren seems like the sort of guy that if he saw someone flip a coin seven times and it came up heads every time, would proclaim that “in recent coin tossing experiments, more coins preferred heads over tails.”

So, RealtyTrac’s report, assuming it matters, showed 24 states experiencing a year-over-year increase in scheduled auctions.

Colorado came in first place with an increase in scheduled auctions of 160 percent year over year. Oregon placed second with a year-over-year increase of 117 percent. Connecticut and New York tied for third with an 81 percent year-over-year increase each. And I bet you can guess you can guess who came in fourth… yes, Oklahoma took fourth place with a year-over-year increase in scheduled auctions of 72 percent.

No surprises there, right? I mean, when I think about the foreclosure crisis, the first states that always come to mind are Colorado, Oregon, Connecticut, New York and of course, Oklahoma… the “sand states,” I think they’re called.

DSNews also pointed out that the state with the highest foreclosure rate for the 11th consecutive month was… shockingly… Florida. Yes, in yet another indication that the foreclosure crisis is behind us, in Florida one in every 400 housing units was in foreclosure in August… almost three times the national average.

And get this… the highest foreclosure rate in August, among metro areas with a population of more than 200,000… was found in Macon, Georgia, with one filing in every 154 homes, according to RealtyTrac, and that seemed like a new leader in the proverbial clubhouse to me. So, I have to ask… is Macon, Georgia considered a “sand state” at this point too?

Finally, in a single paragraph RealtyTrac also reported that…

- For the second consecutive month, foreclosure starts increased month-over-month, making a 12 percent jump from July to August.

- The number stayed flat year-over-year, however.

- The foreclosure process started on more than 55,000 properties in August nationwide.

Obviously, the point to those statements is… well, actually I have no idea what the point to those sentences is or might be.

With all of that being said, I understand that even though repossessions did rise by 2 percent between July and August, Daren’s optimism is largely based on RealtyTrac’s report also saying that lenders repossessing properties via foreclosure fell by 33 percent year-over-year in August… the 21st month with a year-over-year decline nationwide.

I know that sounds like a super positive stat, but it’s also not without its shortcomings. For one thing, it’s a national average that masks the ongoing depth of the problem, as seen above in the various regional numbers.

For another, actual repossessions should be declining as servicers have continued to improve in their ability to modify loans. Of course, that wouldn’t have anything to do with signaling the end of the foreclosure crisis, nor am I at all confident that a gradual reduction of one third is cause for jubilation.

You see… call me madcap, but I still think that borrowers have something to do with driving foreclosures… and that what servicers do or don’t do tells only a part of the story… and the boring, almost insignificant part, at that.

Now… in a completely unrelated story also appearing in DSNews the day after the story on RealtyTrac’s report ran… and included here just in case anyone has started to doubt what I’ve been saying over and over and over again since 2007…

ANALYST PREDICTS HOME PRICE DECLINE IN REPORT TO WHITE HOUSE

Former Goldman Sachs executive Joshua Pollard sent a sobering 18-page report to the White House on September 17th warning of a potential downturn in home prices that could put the country back into a recession before the ripples of the previous one settle.

According to Pollard, the former head of the Goldman’s housing research team, home price appreciation is outpacing income, and the United States is on the brink of a 15 percent decline in home prices over the next three years. Rising interest rates and values will cause already overvalued homes (Pollard says values are 12 percent higher than they should be) to be even further out of sync with reality and generate an unnatural surplus that will itself lead to a slowdown in investor purchases.

Flipped homes have declined 50 percent in the last year, and home flippers are losing money outright in New York City, San Francisco, and Las Vegas according to the report.

If Pollard is correct, the impact on the U.S. economy would be seismic. Overvalued homes, according to his report to President Obama, make up $23 trillion of consumer asset value and “serve as the psychological linchpin” for $17 trillion of invested capital.

Put together, that 15 percent decline translates to a $3.4 trillion cut to consumers’ net worth.

“As an economist, statistician and housing expert, I am lamentably confident that home prices will fall,” he wrote. “Home price devaluation will expose a major financial imbalance that could lower an entire generation’s esteem for the American dream.”

Student debt and a 45 percent underemployment rate for recent college grads has handicapped millennial buyers already, Pollard wrote.

Pollard outlined three distinct stages of the decline—the first of which, the “hot-to-cool” stage, is already underway. This is where home price growth slows and turns negative in large markets across the country. Investors slow their purchases, homebuilders lose pricing power as absorption rates decline, and press outlets shift their market pieces from positive to mixed.

In Stage II, the “demand-to-supply” phase, new negative shocks cause investors to shift from raising prices in an effort to outbid competition to reducing prices to beat future declines. In Stage III, the “deflation and response” phase, consumers come to the decision that now is a bad time to buy a home. Fewer people seek mortgages and banks become less willing to lend.

Consequently, deflation hits, taking jobs with it and triggering calls for new policy.

In other words, Pollard fears the recent past will be prologue. His report squarely targets public finance and housing officials and calls upon the White House to devise “forward-looking monetary policy that balances the risk of raising interest rates,” create a skilled trade externship program for laborers whose jobs are most at risk whenever housing investments drop, and “forcefully rebalance number of homes to the number of households” by reducing the number of new builds as well as the number homes that can force prices down—particularly those that are already vacant, unsafe, and expensive to rehabilitate, the report states.

“The shift from a good market to a bad market occurs quickly, exaggerated by the circular currents of confidence from consumers, investors and lenders in Unison,” Pollard wrote. “When unnatural levels of demand or supply impact the market, prices are pushed in lockstep.”

OH MY GOODNESS… Who would have ever thunk it?

Frankly, I’m both tired of being proven right and shocked that it hasn’t happened sooner and by someone with even more intellectual prominence. Derwood Blomquist just assured the nation that the foreclosure crisis was… what were the exact words he used? Oh yeah, I’ve got them… “well behind us.”

Let’s not be too hard on Doorknob, however, he’s only following in the footsteps of the many mindless sycophants that have come before him. Zandi and Sharga must be so proud.

It is sort of funny though, right? I mean, usually Dimwad at least appears partially potentially correct for a day or two, before being discredited by… what are those things called again? Oh yeah… “facts and actual events.” Not this time though. This time he proved himself award-winningly obtuse within hours of circulating his press release poppycock on how everything was sure to be turning up roses right around the next bend in the road.

But fear not, gentle reader. There is no chance of Dim-and-Dimmer feeling any sort of shame or remorse, for he is paid handsomely for his tangential twaddle, and once paid he is a man who delivers. I cannot, upon such an occasion, shake the words of Dickens’ Bleak House…

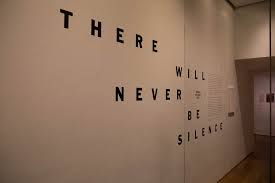

“Never can there come fog too thick, never can there come mud and mire too deep, to assort with the groping and floundering condition, which this High Court of Chancery, most pestilent of hoary sinners, holds this day in the sight of heaven and earth.”

OH, WAIT… one more thing before I leave you to your own devices. In yet another obviously unrelated story that also appeared in DSNews on the very same fine day as all the rest previously referenced and ridiculed…

As further proof of the foreclosure crisis being securely in our collective rear view mirror, Fannie Mae, apparently completely incapable of changing its behavior related to foreclosing in the first place, has announced that they will be making it easier for those once foreclosed upon to once again get on the path to pre-foreclosure…

Fannie Mae Relaxes Waiting Period for Distressed Borrowers

Fannie Mae recently released a report revising the waiting periods for distressed borrowers with a derogatory credit event such as a foreclosure, bankruptcy, short sale, or deed-in-lieu of foreclosure on their credit history to obtain a new loan.

For borrowers with a short sale or deed-in-lieu of foreclosure on their record, Fannie Mae’s new mandated minimum waiting period to become eligible for a new loan is four years. The time is shortened to two years if there are extenuating circumstances.

According to Fannie Mae, extenuating circumstances are defined as “nonrecurring events that are beyond the borrower’s control that result in a sudden, significant, and prolonged reduction in income or a catastrophic increase in financial obligations.”

If a borrower has a foreclosure on his or her credit record, the new minimum waiting period is seven years. Under extenuating circumstances, that period is shortened to three years with some additional requirements for up to seven years.

For those with a bankruptcy (chapter seven or 11), the waiting period is four years (two years with extenuating circumstances). For distressed borrowers with a chapter 13 bankruptcy, the required waiting period is now two years from the discharge date and four years from the dismissal date. If there are extenuating circumstances, the waiting time from the dismissal date is shortened to two years.

If there are multiple bankruptcy filings on a borrower’s record, the waiting period for a new loan is five years if there has been more than one filing in the previous seven years. Under extenuating circumstances, the waiting period is cut to three years from the most recent dismissal or discharge date.

Fannie Mae said in the report that it is “focused on helping lenders to provide access to mortgages for creditworthy borrowers while supporting sustainable homeownership” and that the new policy “provides opportunities for borrowers to obtain a loan to Fannie Mae’s maximum LTV (loan-to-value) sooner after the pre-foreclosure (short) sale or DIL.”

The new policy is effective for loans with application dates on or after August 16, 2014.

Under the previous policy, the standard waiting period for borrowers with a derogatory credit event was two years with a maximum 80 percent LTV ratio; four years with a maximum 90 percent LTV ratio; or borrowers were eligible for a new loan after a standard seven-year waiting period. For borrowers with extenuating circumstances, the previous waiting period was two years with a maximum 90 percent LTV ratio.

So… as the man once said: “Other than that Mrs. Lincoln… how did you like the play?”

It seems that Fannie has discovered that the only thing it finds less appealing than granting principal reductions, or admitting that it was wrong about anything… is not having anyone to which to loan money concerning the purchase of their own American Dream.

My guess is that someone over at the gargantuan GSE got out his Hello Kitty calculator and forecasted that on the current path they would likely have to start loaning money to minors and undocumented workers sometime in 2020, were the rules not to change.

As I’ve told many a homeowner over the last five years… it may seem as if the banks have all the power, but it is only an illusion. For we can lose everything and be just fine, but without our willingness to borrow and spend, they cannot survive off the federal ventilator. Give it just a little more time and I’m telling you that banks will be giving away condos in Miami when you open a business checking account. As in, “Sir, would you like a complementary condo with that account?”

Okay, I could go on… seriously, I could… but I’m afraid of giving my readers whiplash were I to continue reporting on what various members of our political and financial class have been saying and doing, it is clear that many are feeling like Christian Scientists… with appendicitis.

So, cue the eminent domain people… come on… let’s make some noise and really get this election year party started in earnest, shall we?

Rock on, my most treasured friends… by all means, do rock on.

Mandelman out.