Anyone Care to Bet? We’re in a Recession Now or Will Be Soon.

Okay, so I didn’t want to say this, although I’ve been thinking it for a couple of months now… I’d bet money we’re in a recession right now, have been for quite a few months now, at least since January, but maybe even since the fourth quarter of last year. I’m telling you, over the years I’ve seen that I’m a damn recession barometer. Some people can tell when it’s going to rain, well… I can tell you when the economy is raining crap.

And I don’t mean the kind of recession we’ve been having since 2008, I mean the one they tell us about because it gets so bad they can’t hide the numbers any longer. You know, like this sort of thing announced this coming August while half the country is on vacation… “Economists are saying the recession actually started during the fourth quarter of last year…”

And then everybody goes, “Huh? I thought we were having a housing recovery and homes were worth flipping again. I was having multiple-offergasms.”

I’m sorry, no. Actually, we’re in deep kimchi.

First, consider these horrific mortgage origination numbers for the first quarter of this year compared with the same quarter last year… at Citigroup and JPMorgan Chase.

- Mortgage Originations at Citigroup DOWN 71% in the first quarter of this year, compared with the same quarter last year. That’s $5.2 billion during the first quarter this year, compared with $18 billion in Q1 of 2013, or if you’d prefer… from $18 billion last year to just $5.2 billion this year… or in other words… HOLY CRAP!

- Mortgage Originations at JPMorgan Chase DOWN 68% in first quarter this year compared with first quarter one year ago. That’s $17 billion originated during the first quarter of this year, compared to $52.7 billion in mortgages originated during Q1 of 2013.

HOLY BLOMQUIST BATMAN!

That’s a downward trend like Titanic was on a downward trend to the bottom of the Atlantic.

And let there be no mystery about this… according to the Bureau of Labor Statistics, in a terrifying 20 PERCENT of American families no one has a job. There are roughly 80 million families in this country, and in over 16 million of them, no one is working. Do the math… 41 PERCENT of all working age Americans do not have jobs.

BUT WAIT… the reason housing was slow during the first quarter of this year was chilly weather back East, or in Florida, which never explained the slow down in the West, where now things are booming… although there’s no inventory. I don’t know, I can’t keep track of all the silly spin anymore.

When mortgage originations are that far down, what does that tell you about the rest of the economy? Let’s look at first quarter earnings this year…

How about McDonalds’ earnings falling by $66 million, or Wal-Mart profits down by $220 million, or how about Staples profit dropping by 44 percent, and Urban Outfitters earnings crumble by 20 percent?

Can we connect these dots? Housing market takes a dive, consumer spending craters causing retail earnings to collapse, with underlying employment numbers somewhere south of ghastly.

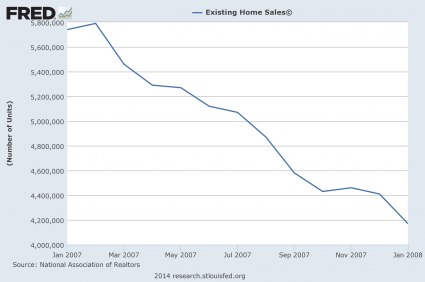

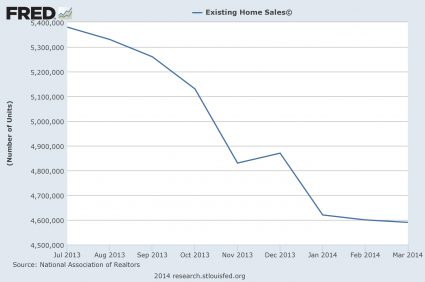

What’s the difference between now and back in 2007, as far as leading indicators are concerned? Well, the first chart below reflects existing home sales in ’07 and the second today.

2007

2014

I don’t care what anyone opines… those two charts are eerily similar.

But wait… let me guess Zandi, Sharga and Blomquist all see the housing markets recovering by the fourth quarter of this year. Gotcha’… I’ll go hold my breath.

Mandelman out.

EXTRA! EXTRA!

P.S. The day after I wrote this article, ZeroHedge reported that, were it not for a sharp increase in health care spending in the first quarter… which was only the result of ObamaCare… U.S. GDP actually SHRUNK BY 2 PERCENT. And just so you know, that’s not just bad… it’s unthinkable. If that were to continue, our GDP would contract by 8 percent for the year, right? 2 percent x 4 quarters = 8 percent, right?

And that would be like the end of the world. Now, I’m NOT saying that’s what will happen, because it WON’T. But, we are in a recession, no matter what the pundits want you to believe, because I guarantee you that absent fourth quarter sales from holiday shopping, we were negative in terms of growth in the 4th quarter of last year too… and two negative quarters of GDP equals… anyone, anyone?

Now, lets not always see the same hands… RECESSION. Very good, and thank you for playing along at home.

All I can say is… I knew it back in February… I could feel it in my bones.

Stay tuned for all the forecasters who will be out tomorrow forecasting positive things for the year ahead… because that’s all they can do.