Can We All at Least Agree on This?

Oh, I know… it’s such a complex problem we’re having lately. Clearly, it’s far too complicated a problem for any normal mortal brain to grasp…. there seems no hope that we shall ever be able to come to terms with what’s transpired.

Fine. Absolutely ridiculous… but fine, I guess. It’s rocket surgery… so be it.

It’s no wonder that we’re struggling to understand things, because according to some, the contributing factors to today’s too-complicated-to-understand crisis go all the way back to 1979. I’m frankly surprised no one has tracked its roots back to the 1930s… although as I say that, I’m sure some have done just that. Some are even blaming excessive regulation, a claim so entirely preposterous that it defies imagination. To blame our global economic meltdown on excessive regulation, is like blaming 9-11 on excessive airport security.

The Attorneys General in Nevada, Massachusetts, Maryland, Arizona, and it is all but certain that there will be others to be named later, have all filed foreclosure process related lawsuits that read like John Grisham novels and in a few cases have even brought criminal charges having to do with what is clearly rampant forgery and fraud in the foreclosure process.

The Office of the Comptroller of the Currency (“OCC”) concluded their investigations in April of 2011, issuing “consent orders,” which basically said that the bankers were guilty of unsafe and unsound practices related to foreclosures, also specified a laundry list of felonious acts and nefarious behaviors.

And, although many are complaining… and perhaps justifiably so… about the absence of criminal prosecutions related to the bankrupting of our financial institutions, we have seen some record-setting settlements to civil lawsuits brought by the SEC… the agency’s settling with Goldman Sachs for $550 million related to the bank’s lack of disclosure in the Abacus 2007-AC1 CDO comes immediately to mind. Oh, I know… GS admitted no wrongdoing, but that’s the sort of statement issued to placate lawyers and young children. No one agrees to pay half a billion dollars for doing nothing wrong.

The proposed $285 million mortgage securities fraud settlement between Citigroup and the Securities and Exchange Commission was more of the same non-admission nor denial of guilt silliness, but at least it was rejected by Judge Jed Rakoff who described the deal as being “neither fair, nor reasonable, nor adequate, nor in the public interest,” and further that it deprived the public “of ever knowing the truth in a matter of obvious public importance.”

Citi is to face trial over the allegations in July 2012, but grown-ups should all know the score here… these banks were dirty in their dealings and they are guilty as all get out. If that weren’t true, they would not be readily offering to settle for three hundred million dollars, and saying that the settlement does not include an admission of guilt is laughable.

There’s also a cadre of class action lawsuits against banks and mortgage servicers whose complaints filed with the courts make damn clear that laws have been broken with reckless abandon, regardless of the settlements-to-come, which I’m sure will also be delivered in no admission of guilt wrapping paper.

Okay, but for the moment anyway… I’m going to say something that will no doubt bother many engaged in the battle for truth, justice and the American way: So what and who cares?

I don’t want to debate with anyone whether they think the problem is bigger than I’ve made it out to be… or smaller. That’s right… I don’t care which side of this fight you’re on. For the purposes of this article, you can be a foreclosure defense fanatic who believes that our democracy, the rule of law, and entire free world’s fiscal future hangs in the balance, or you can be a banking industry apologist still claiming a victory in the Ibanez decision and describing robo-signing as merely dotting t’s and crossing i’s… and I don’t care which.

In simpler terms, maybe you think the situation related to foreclosures in this country is a floor wax… or maybe you see it as being a desert topping… my point here applies equally across the board regardless of your view.

However the debate is ultimately resolved, whether foreclosures are ultimately judged floor wax or desert topping… can we all agree on one thing?

The ANSWER to the problems we’re debating related to foreclosures CANNOT and WILL NOT be allowed to be forging signatures on fraudulent documents presented in courts and recorded in our public records. Can we all please agree that there is NO CHANCE THOSE ARE THE ANSWERS… and I don’t give a rat’s petute how you want to frame the questions… the solution cannot be forgery and fraud, right?

It’s become abundantly clear that Wall Street’s investment bankers, in their bubble-inspired rush to securitize anything with the potential to generate a payment stream, and then rip someone’s face off, derivatively speaking… they screwed up everything but their bonus calculations. (That documentation they unwaveringly get right, don’t you know.)

Who owns your loan? I don’t know… and for the moment, I don’t care. Is the MERS business model salubrious and copacetic, or has it undermined and permanently destroyed property rights in this country? Not sure, and for the moment not interested.

Did investors invest in “Mortgage-backed Securities?” Or, does the acronym MBS more appropriately stand for, “Mouthy-backed Sacrilege,” or perhaps, “Monetary-babbled Sacrifices?” For the purposes of today’s discussion… just give it a rest.

For the moment, I don’t care about Pooling and Servicing Agreements unless they are in place to make sure a pool stays both clean and heated through the winter months. And if the word “tranches” is really French for “slices,” then I’ll take a couple of tranches of the French Toast, three tranches of bacon, not too crispy, and your finest maple syrup, Garçon.

And I recognize that there is a veritable cluster of you still insistent that the irresponsible acts of Stockton, California’s homeowners effectively eviscerated all of Wall Street’s investment banking powerhouses along with most of the Sovereign Wealth Funds on the planet… and for today… why not… have at it. For today, I’m even willing to endure your distinctive brand of faith-based foolishness.

But… regardless of how the questions associated with the foreclosure crisis continue to be answered, whether in the courts or state legislatures, we should be able to agree that whatever the questions are… the answer isn’t to allow forgeries of signatures on a fraudulent documents in order to evict someone from a home that can’t be sold for years anyway. Fraud and forgery are never the answer to anything in a society governed by the rule of law.

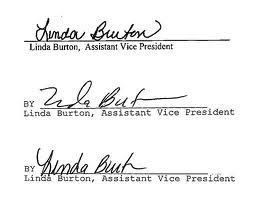

If that is going to be allowed to happen, we… and I mean WE, as in ALL OF US… should demand that we stop signing such things altogether. If a Linda Green look-a-like is going to sign a fraudulent affidavit so that it can be illegally notarized… just don’t sign it or notarize it.

We don’t need to sign and notarize things if we are committing fraud and forgery every time we do so. And we very clearly are… it is NOT, as the banks have told us in the past… any sort of isolated incident.

How do we know that? It’s simple. Nevada gave us the proof when it passed Assembly Bill 284, which took effect in October 2011.

The new state law requires those foreclosing on a home to file an affidavit proving they have the right to bring the action — and it increases civil and criminal penalties for using fraudulent documents in a foreclosure. That same month, foreclosures in Nevada declined by 75 percent.

History cannot be permitted to look back on this crisis and say… well, we fixed it looking the other way on issues that are quite literally forgery and fraud. It’s as simple as that. I don’t care who is or isn’t making their mortgage payment… that’s irrelevant. I don’t care if it’s inconvenient for the banks to do something else. But we cannot continue to allow our nation’s financial institutions to lie about the nature of the problem and then continue to attempt to solve whatever it is through rampant forgery and fraud.

It has to stop and I do mean NOW. If you are reading this and you don’t see it the same way, you either lack the capacity for rational thought… or you are just an ass who would be well-served to avoid debating me in public, I assure you.

Euphemistically, they’re called austerity measures. They hurt the oldest, youngest and poorest in a society. And although you may not feel their sharp edge quite yet, such programs are very much upon us.

Those who know me know my views about foreclosures today. In my view, it’s an economic crisis of endemic proportion that is needlessly incinerating the accumulated wealth of our country’s middle class to such a degree that at 50 years old, the idea of recovery in my lifetime is already laughable. I see the foreclosure crisis as nothing more than a lose-lose scenario… a pointless race to a cancerous bottom with no prospects for winners to be present at its finish line.

I also see the foreclosure crisis through its numerical realities that will soon leave us with no choices… no options… like flotsam and jetsam, a society entirely lost, doomed to invariably and inadequately react, but with no hope of meaningful improvement. I see the iceberg dead ahead, as the band plays on.

According to the Center on Budget and Policy Priorities, states are facing record shortfalls in fiscal year 2012 because state tax collections remain low, the cost of providing services is rising, and emergency federal aid has largely been depleted. In 2012, state budget shortfalls started at $103 billion, but some percentage of that amount has already been closed by spending cuts as shown below. However, 24 states have already projected shortfalls totaling $46 billion for FY2013. As more states prepare estimates, this total is likely to grow.

The U.S. Census Bureau reports declines in state tax collections during this economic slowdown are the worst ever. Sales taxes provide the largest source of state tax revenue, and they are steadily declining due to reductions in personal consumption and business purchases. Income taxes and other taxes are also falling as wages and investment income decline.

Of course, spending cuts also reduce economic growth even further. With the federal aid for states now essentially over, taxes have to be increased and at least 30 states already have enacted tax increases, closed loopholes, restricted tax credits, increased tobacco taxes, raised tuitions, or implemented other revenue-raising measures.

And for those who think they are somehow going to remain above it all… the plain fact is, tax increases on higher-income families are understood to be the least damaging mechanism for addressing state fiscal deficits in the short run. Cutting government spending, or reductions in transfer payments to lower-income families have been proven to be more damaging to a state’s economy than tax increases focused on higher-income families.

When this has happened in Europe, we call them “austerity programs,” and they negatively and significantly impact everyone. As I’ve assured my readers on countless occasions, no one is getting out of this unscathed.

In California and Massachusetts, recent studies have been conducted to quantify the monetary costs directly attributed to the foreclosure crisis. Massachusetts found the grand total to be $4 billion a month, including lost equity, a number especially striking because it’s twice the amount forecasted by the CBO in 2007-08.

California’s study, conducted by the California Reinvestment Coalition in conjunction with the Alliance of Californians for Community Empowerment, broke down the costs of the crisis by county. The following represents the costs of foreclosures for Los Angeles County alone, realized to-date:

- Costs to local governments – $19,229 PER FORECLOSURE for increased costs of safety inspections, police and fire calls, trash removal, and maintenance. Total costs to LA County to-date… $1.2 billion.

- Property tax revenue losses of $481 million.

- Homeowner equity lost to-date – $78.8 billion.

- Between 2008 – 2012 Californians will have lost 2 million homes to foreclosure. The costs to the state’s homeowners, local governments and property taxes are estimated to be $650 BILLION statewide.

For fiscal year 2012, California faces a $9.6 billion budget shortfall. The state has already cut nearly all funding for services supporting HIV/AIDS patients, and it has completely eliminated funding for the state’s domestic violence shelter program and maternal, child, and adolescent health programs.

In addition, California has cut funding for the state’s Healthy Families program, the state’s CHIP program. To make up for the lost funds, the nearly 1 million children in the program will have to pay more for visits to health care providers, and many will have to pay higher premiums as well. These cost increases are certain to cause some percentage of families to drop from the program.

These types of cuts to state spending are only the tip of the iceberg, no pun intended.

- An estimated 8,200 families in Arizona lost eligibility for temporary cash assistance. The time limit for that assistance was cut to 36 months from 60.

- Alabama has ended homemaker services for approximately 1,100 older adults. These services often allow people to stay in their own homes and avoid nursing home care.

- Colorado cut public school spending by $260 million, nearly a 5 percent decline from fiscal year 2010. The cuts equal more than $400 per student.

- Florida’s 11 public universities raised tuition by 15 percent for the 2010-11 academic year and with a similar increase in 2009-10, means a total two-year increase of 32 percent.

- In Minnesota, as a result of higher education funding cuts, approximately 9,400 students lost their state financial aid grants entirely, and the remaining state financial aid recipients will see their grants cut by 19 percent.

- Virginia’s $700 million in K-12 education cuts for the current biennium include the state’s share of school district operating and capital expenses, and funding for class-size reduction in Kindergarten through third grade.

- Washington reduced assistance for thousands of people physically or mentally incapacitated and unable to work in 2011. For 28,000 adults enrolled in the state’s Disability Lifeline program, the typical monthly benefit has fallen by $81 to $258 from $339.

- Changes in Connecticut’s Medicaid program will result in over 220,000 pregnant women, parents, caretaker relatives and disabled and elderly adults losing coverage for over-the-counter medications and nutritional supplements.

- Massachusetts has cut $2.2 million from HIV/AIDS prevention programs, and cut dental benefits for approximately 700,000 low-income residents. The cuts also ended a health insurance program for low-income legal immigrants.

- Michigan will end a medical coverage program for 950 adults with dependent children unable to afford employer-sponsored health insurance after transitioning from welfare to work and exhausting the 12-month transitional medical assistance available to them.

- New Hampshire’s fiscal year 2011 budget reduced the state hospital’s beds by 15, which will result in 500 fewer patients treated per year.

- New Jersey’s cuts will result in approximately 50,700 low-income adults losing access to health care coverage.

- Washington is increasing premiums by an average of 70 percent for a health plan serving low-income residents. Premiums for the poorest plan members will double and are expected to cause between 7,000 and 17,000 enrollees with no medical plan coverage.

- Several states, including California, Michigan, Nevada, and Utah, have dropped coverage of dental and/or vision services for adult Medicaid recipients.

And that’s not even close to the whole story on what are a growing number of austerity programs that will soon be felt by every American citizen in one way or another.

- At least 31 states have implemented cuts that will restrict low-income children’s or families’ eligibility for health insurance or reduce their access to health care services.

- At least 29 states plus the District of Columbia are cutting medical, rehabilitative, home care, or other services needed by low-income people who are elderly or have disabilities, or are significantly increasing the cost of these services.

- At least 34 states and the District of Columbia are cutting aid to K-12 schools and various education programs.

- At least 43 states have cut assistance to public colleges and universities, resulting in reductions in faculty and staff in addition to tuition increases.

- And at least 44 states and the District of Columbia have made cuts affecting state government employees.

The Center on Budget and Policy Priorities also reports that at least 34 states and the District of Columbia have cut spending on K-12 educational programs…

- Arizona eliminated preschool for 4,328 children, funding for schools to provide additional support to disadvantaged children from preschool to third grade, and funding for books, computers, and other classroom supplies. The state also halved funding for kindergarten, leaving parents with the cost of keeping children in school beyond a half-day schedule.

- California reduced K-12 aid to local school districts by billions of dollars and cut a variety of programs, including adult literacy instruction and help for high-needs students.

- Colorado reduced public school spending in FY 2011 by $260 million, $400 per student.

- Georgia cut state funding for K-12 education in FY 2011 by $403 million. The cut has led to exempting local school districts from class size requirements.

- Hawaii shortened the school year by 17 days and furloughed teachers for those days.

- Illinois cut school education funding by $311 million in 2011. Cuts included the elimination of a grant program intended to improve the reading and study skills of at-risk students from kindergarten through the 6thgrade.

- Mississippi cut by 7.2 percent funding for the Mississippi Adequate Education Program, a program to bring per-pupil K-12 spending up to adequate levels in every district.

- Massachusetts cut state education aid by $115.6 million in FY 2011. It also made a $4.6 million, or 16 percent cut to funding for early intervention services, which help special-needs children.

- New Jersey cut funding for afterschool programs aimed to enhance student achievement and keep students safe between the hours of 3 and 6 p.m. The cut will likely cause more than 11,000 students to lose access to the programs and 1,100 staff workers to lose jobs.

- North Carolina cut by 21 percent funding for a program targeted at small schools in low-income areas and with a high need for social workers and nurses. As a result, 20 schools will be left without a social worker or nurse.

- In Virginia a $500 million reduction in state funding for some 13,000 support staff such as janitors, school nurses, and school psychologists was made permanent.

Other services are being cut as well…

- California is eliminating cost-of-living adjustments to assistance programs for low-income families and cutting child care subsidies.

- Colorado is cutting payments for mental health providers and eliminating funding for treatment for an estimated 626 patients each year in the state’s mental health institutes.

- In Connecticut, the governor has ordered budget cuts that help prevent child abuse and provide legal services for foster children.

- The District of Columbia cut its homeless services funding by more than $12 million, or 20 percent. It also reduced its cash assistance payments to needy families and cut funding for services that help low-income residents stay in homes and communities.

- The South Carolina Department of Juvenile Justice has already lost almost one-fourth of its state funding, resulting in over 260 layoffs and the closing of five group homes, two dormitories, and 25 after-school programs.

- Connecticut, Delaware, Maryland, Michigan, Minnesota, New Hampshire, New Jersey, New York, Ohio, Rhode Island, Virginia, Wisconsin, and Wyoming, have implemented reductions in funding for policing, child care assistance, meals for the elderly, hospice care, and various services for veterans and seniors.

The U.S. Bureau of Labor Statistics reports that state spending cuts are having a significant impact on employment. The total number of people employed by state and local governments has fallen by over 400,000 since August 2008, while the need for services produced by those workers has increased.

We’ve ignored it so long it’s become insurmountable… well, that’s just great.

Today, California has 2 million homes in some stage of the foreclosure process… 40 percent have made no payment for over two years, and 70 percent have made no payment for over a year. If each of the 2 million homeowners availed themselves of just 10 hours of legal assistance, it would require roughly 15,000 years for a lawyer to help everyone. To get through that workload in a year, we’d need 15,000 trained professionals and attorneys to help… and yet the state continues to offer no guidance to it’s citizens outside of “call your bank or a HUD counselor,” a strategy that hasn’t changed a single thing for the better over the last four years.

Quite incredibly, our responses and attempts to mitigate the damage caused by the foreclosure crisis at both state and federal levels have ALL been spectacular failures… and there have been dozens of plans and programs backed by un-spent budgets rising into the hundreds of billions of dollars. Nineteen “hardest hit states” have received billions… and there is nothing meaningful to show for any of it.

Alabama – $162,521,345

Arizona – $267,766,006

California – $1,975,334,096

Florida – $1,057,839,136

Georgia – $339,255,819

Illinois – $445,603,557

Indiana – $221,694,139

Kentucky – $148,901,875

Michigan – $498,605,738

Mississippi – $101,888,323

Nevada – $194,026,240

New Jersey – $300,548,144

North Carolina – $482,781,786

Ohio – $570,395,099

Oregon – $220,042,786

Rhode Island – $79,351,573

South Carolina – $295,431,547

Tennessee – $217,315,593

Washington DC – $20,697,198

In point of fact, HAMP is our country’s superstar success by all measures, a program that began with $75 billion, first reduced to $50 billion, and most recently to some $37 billion… while amounts spent to-date are reported by the GAO to be $2.4 billion, and not all of that was spent on HAMP.

So, consider this… If we had a crisis affecting hamsters and we budgeted $75 billion or $37 billion to address it… and three years later we had only spent a couple of billion, there would be a national outcry denigrating those in charge as being guilty of cruelty to hamsters.

And just in case you weren’t moved by the state budget cuts I listed above, please don’t be lazy about this… read them again. Put yourself in the shoes of the people who have lost access to the programs described. And understand that I didn’t even list half of the cuts already in place… not even half.

And think about what happens when you take away access to a doctor for a child with special needs from a parent who has nowhere else to turn. They often find a way, however, a parent’s love knows no bounds. And sometimes the way they find puts a gun in your face.

Mandelman out.

ENOUGH FAILING… NO ONE FAILS THAT MANY TIMES IN A ROW.

Send me your email TODAY and be a registered MandelmanDOER. We don’t have much time left before none of this matters anymore. Don’t worry… I only need your email so we can communicate without my needing to post everything on Mandelman Matters… in some things we’ll want the element of surprise. It’s not any sort of business gimmick… I hate having to keep track of emails, believe me.